Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

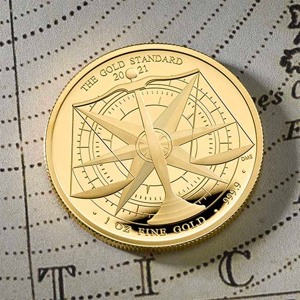

Forbes: It's Time to Lift the Taboo and Bring Back The Gold Standard

Talking about the gold standard is strictly taboo in economics and among politicians. It is long past time to get rid of this taboo, says Steve Forbes, founder of the media magazine Forbes.

“From the time of George Washington until the early 1970s, the gold standard worked successfully in the United States. For years now, the gold standard has been a taboo subject among economists and politicians, who have scorned to even discuss it,” Forbes said in his video speech.

“It’s bad, because the gold standard would have prevented the financial disaster of the century and the current problems. We cannot have inflation with the gold standard. This would have prevented the horrors of the 2008 financial crisis” Forbes explained.

According to Forbes, this would also have helped avoid an unprecedented squeeze on interest rates and the frenzied printing of money that occurred during and before the pandemic. All this led us to the current mess, he says.

What is the gold standard?

Firstly, it is important to understand what The Gold Standard is. The “gold standard” in the context of the United States refers to a monetary system in which the value of a country’s currency, in this case, the U.S. dollar, is directly tied to and backed by a specific quantity of gold. Under the gold standard, each unit of currency (e.g., a dollar bill) is convertible into a fixed amount of gold. This means that the government or central bank must hold a reserve of gold equal to the total value of currency in circulation.

Gold as a reliable unit of measure

“Money is a measure of value, just as a scale measures weight, a clock measures time or a ruler measures distance,” says Forbes. “We all know instinctively that we need fixed weights and measures in the market as well. A litre does not change every day, nor how many grams go into a kilogram, how many centimeters go into a meter or how many minutes go into an hour.”

An economy works best when its currency is a reliable measure of value. For many different reasons, gold has held its intrinsic value for thousands of years better than anything else — better than silver, platinum, palladium, copper, cryptocurrencies or coconuts, Forbes explained.

“When the price of gold changes, its value does not change, but the value of the currency in which the gold is measured. Money that has a fixed value makes it easier to buy, sell and invest – just as knowing the weight of specific products makes it easier to trade . A litre of ice cream is the same size today as it was yesterday, says Forbes.

Let’s start the debate

“If we go back to the gold standard and set the price of an ounce at, say, $1,900, that would mean that if the price of gold rose above $1,900, the supply of money would have to be reduced. If it drops lower, then the amount of money needs to be increased”, Forbes said.

“Contrary to popular myth, the gold standard does not artificially limit the economy’s money supply. It simply means that the money that is created has a stable value”

Forbes explained.

“There was no plan to abandon the gold standard in the early 1970s, but the US blew up the system and we have never recovered.”

According to Forbes, average economic growth since then has been well below the historical average. After recovering from the distortions of World War II, the average annual growth rate in the United States was 4.2 percent until the gold standard was abandoned. Since then, the average growth has been 2.7 percent until the start of the pandemic.

“If, thanks to the gold standard, we had maintained this rate of growth, an average household’s annual income would be $110,000 instead of $70,000,” he gave as an example. “Let’s throw the gold taboo and start a debate!”