Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

The big recap: what happened in the gold market in 2022?

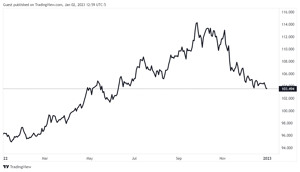

Last year was a very volatile year for the gold market. A sharp rise at the beginning of the year was followed by a rapid fall. While gold price ended the year slightly down in dollars, in euros the yellow metal gained 7%. Gold also managed to outperform equity and bond markets. The narrative was shaped by three major themes last year – central bank activity, inflation and the war in Ukraine.

The following analysis focuses on a one-year perspective. It also excludes factors that affect gold over a much longer time horizon, such as the long and decades-long money squeeze, what is happening with today’s monetary system, history and long-term trends in inflation and commodity markets. On a monthly basis, it is the perceptions prevailing in financial markets and among investment funds that largely shape the price of gold, which we focus on below.

- In the first quarter, the price of all the so-called safe-haven assets was driven up by the rather unexpected start of the war in Ukraine. This drove gold to a near record high.

- In the second quarter, gold came under pressure again as central banks started to rapidly raise interest rates due to high inflation. Higher interest rates in turn pushed up the dollar and bond yields, which put pressure on gold.

- In the third quarter, gold hit a one-year low amid a rapid rise in interest rates, while the dollar rose to a more than 20-year high.

- In the fourth quarter, the dollar started to depreciate and expectations of interest rate rises became more subdued. Gold prices reached a six-month high in the last days of the year.

Last year, gold depreciated by 0.3 percent in dollar terms to end the year at $1,822 per ounce. The price of silver per ounce rose 2.6 percent to $23.9 an ounce last year. In euro terms, however, the price of gold rose by 7 per cent to €1,699 per ounce. In British pounds, the price of gold rose 13 percent to £1,507.

However, gold managed to show a better return than the Standard & Poor’s 500, the largest US stock index, which fell by almost 20 percent overall, while the prices of major government bonds were also falling (when bond prices fall, their yields rise and vice versa). Gold also outperformed copper and palladium, but underperformed both silver and platinum.

Gold price in 2022 (in dollars). Source: TradingView

The war in Ukraine brought gold close to record highs

Last year’s price peak was reached in the spring – on 8 March, gold closed at 2050 dollars an ounce. The price surge in February and March was due to the war in Ukraine and the acceleration of inflation. The August 2020 gold price peak was only $13 short.

By March, annual inflation in the US had risen to 8.5%, the highest level since the early 1980s. Inflation in Europe reached 7.4% at the same time. At the same time, the war in Ukraine was pushing up commodity prices, pushing up costs for natural gas, oil and cereals. Both higher inflation and the rapid rise in commodities boosted gold prices.

After that, a period of depreciation lasting more than six months began. This took the gold price to $1,615 an ounce by the end of September, its lowest level since April 2020. The main reasons for this were the rapid rise in the dollar index (DXY) and the aggressive interest rate hikes initiated by the Federal Reserve. The dollar index measures the performance of the American currency against its six major rivals. At the end of September, it reached its highest level in more than 20 years.

The dollar index (DXY) has started to fall after rising until the autumn. Source. TradingView

Rise in interest rates behind the rise of the dollar

The dollar’s rapid rise was driven by the Federal Reserve’s aggressive interest rate hikes, as well as the war in Ukraine and the energy crisis in Europe. It is specifically the euro that accounts for most of the weight in the dollar index. In September, the euro fell to parity with the dollar (a 1:1 exchange rate), which last happened in the early 2000s. When the dollar falls, gold becomes cheaper for users of other currencies. In turn, the lower gold prices in other currencies boosts demand for gold.

In April, the Federal Reserve’s benchmark interest rate was still set at 0.5%, but by the end of the year it had risen to 4.5%. The last time the central bank raised interest rates so rapidly was during the period of rapid inflation in the 1970s, another period marked by the energy crisis caused by the refusal of the oil cartel OPEC countries to sell oil to the US.

Higher interest rates have pushed up government bond yields rapidly this year. In March, US 10-year Treasuries yielded less than 2 percent, but in the autumn they rose to 4.5 percent. Now yields have come down a little and are trading at 3.8 percent. Higher bond yields raise the alternative options for gold – if more interest is paid on bonds, there are more investors willing to buy bonds instead of gold.

The end of the year also made gold shine

Looking at the technical picture, gold’s autumn slump turned out to be a fairly strong support point, with the price bouncing back three times, the second time in October and the third time in early November, followed by a rapid recovery.

A few days before the end of the year, gold reached $1 833 an ounce, its highest level in six months. The year-end rally has been largely driven by the depreciation of the dollar and expectations that the Federal Reserve is bringing down the pace of interest rate rises.

Keep an eye out for our article about what to expect from the gold markets in 2023.