Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Trust is the bedrock of the intricate world of precious metals trading for investment purposes. Recognising the importance of this factor, Tavex Bullion maintains its commitment to offer only products derived from the world’s preeminent and most highly regarded refineries and mints. Our guiding principle is to conduct transactions with absolute transparency, dependability, and consistency.

By implementing these standards, we ensure that you have access to products with absolute guarantees and internationally recognised bullion. Consistently adhering to the highest quality standards, our products have a precise gold and silver content. You are able to exchange these assets across international borders at values that closely resemble the current market price of precious metals.

Consequently, our offering provides you with a cost-effective and adaptable mechanism for hedging against inflationary trends while simultaneously developing a solid savings portfolio for future requirements. We view our role not only as your bullion partner, but also as a partner in your pursuit of financial stability and expansion.

In an effort to provide you with the best possible service, we are proudly partnered with the most renowned mints and refineries in the precious metals investment market. Below is a list of our partners, followed by a description of their ascent to become the most prominent refiners and mints in the global precious metals investment market. Our partnership with these industry leaders is display of our dedication to excellence and reaffirms our commitment to providing you with dependable and high-value investment options.

The Royal Mint

As The Royal Mint has progressed through history, it has undergone a transformation that has seen it change from a quaint institution to a sophisticated, cutting-edge manufacturing organisation. It is a proud government-owned company today with a lengthy history dating back more than 1,000 years. This revered institution has followed the same historical course as the UK, enduring wars, political upheavals, and socioeconomic advancements while simultaneously embracing and promoting technological innovation.

In Stock

In Stock

The products of the Royal Mint are an ideal starting point for those looking to establish a savings programme based on these priceless commodities or looking to diversify their current investment portfolio in the complex world of precious metals investment. The Royal Mint’s products, regarded as the core of the UK’s gold trade, are a symbol of reliability and trust in this industry.

Read more from our articles below:

- The Royal Mint: A 1,100-Year History of Coin Production and Preservation of British Heritage

- A Royal Investment: The King Charles III Coronation Gold Sovereign from The Royal Mint

- The Majestic 1oz British Britannia: King Charles III Coronation Gold Bullion Coin by the Royal Mint

- The Coronation Coins: A Royal Revelation

Valcambi Suisse

Founded in 1961, Valcambi Suisse is the largest Swiss refinery in terms of the volume of gold processed. It processed 1,200 tons of gold in 2020, which is 50% more than the second spot when ranking by volume of gold processed.

In Stock

In Stock

Gold bullions manufactured by Valcambi are among the most recognised and sought after gold bullions in the world. Moreover, Valcambi’s offer includes a wide variety of gold bars, coins and medallions.

Valcambi is also an innovator in social relations. In contrast to its traditional gold products, the refinery has launched a line of green gold products. Green gold is extracted and delivered only from mines that meet the highest standards of respect for the environment and working conditions of employees.

Valcambi Suisse Gold Bullion Bar

PAMP (Produits Artistiques Métaux Précieux)

PAMP (Produits Artistiques Métaux Précieux) is another Swiss refinery whose products are offered by Tavex Bullion. The working capacity is 450 tons of gold and 600 tons of silver per year. Since between 65% and 75% of the world’s gold is refined in Switzerland, PAMP remains one of the world’s largest producers of investment gold.

One of the most distinguishing characteristics of gold bullions produced by a renowned refinery or mint is their quality of work. PAMP is an innovative company, being the first to introduce the production of ingots engraved with the effigy of famous mythological or historical figures. It is, therefore, no surprise that its products are popular around the world.

Preorder

Preorder

Perhaps the most popular gold bullion PAMP bears the image of the goddess of prosperity Fortuna, after which it received its name. The bullion has a gold purity of 99.99% and is the first investment bullion in the world to display a work of art.

Gold bullion PAMP Fortuna Bullion Bar

PAMP became the first refinery in the world to receive the London Bullion Market Association’s Gold Certificate of Responsibility in 2015. The document certifies that the company’s activities do not contribute to conflicts around the world, human rights violations, support terrorist organisations and that it respects high standards for environmental, social and management policies.

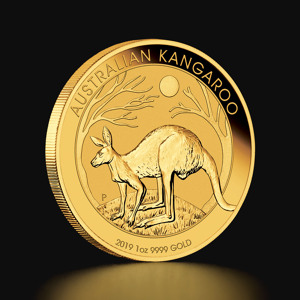

Australian Mint (Perth Mint)

The Perth Mint was founded in 1899 as a branch of the British Royal Mint. Also, a new gold mine was launched in Australia. Although it was not the first in the market, its predecessors, the Sydney Mint and the Melbourne Mint, no longer exist.

In Stock

In Stock

In 1957, the Australian Mint was the first in the world to obtain “the purest gold”. The gold plate produced by the institution was 99.9999% pure. The feat was so impressive that some institutions, such as the British Royal Mint, ordered several copies to be used for comparison with their own gold coins.

In addition to technological advances, the Australian Mint has also gained commercial success. In 1987, they introduced the gold coin (which later became the Australian Kangaroo), which became an instant bestseller among gold enthusiasts. On the day of the debut, orders were placed for bullions with a total weight of 150,000 troy ounces (or 4.8 tons). Perth Mint anticipated a maximum demand of 130,000 troy ounces in the first 3 months.

Like the other refineries on the list, the Australian Mint offers a wide portfolio of collectable gold and silver products. These include the series of cyclical investment gold bullion coins. Their design is modified annually to present the animal to which the respective year of the Chinese Lunar calendar is dedicated.

Collectable coins minted by Perth Mint have won dozens of awards for their design over the years. The mint also produces Australian dollars.

Austrian Mint (Münze Österreich)

Münze Österreich, being the original name of the Austrian Mint, is the oldest mint that Tavex collaborates with. The history of minting is related to Richard the Lionheart, who was held captive for a year by Duke Leopold V. In 1194, the English king paid 12 tons of silver as a ransom, and the duke used the silver to mint the first coins in Vienna.

In Stock

In Stock

In the first half of the 18th century, an engraving academy was founded inside the mint, which still exists today, and the mastery of engravers is reflected by the coins produced here. The most popular is the gold bullion coin – The Vienna Philharmonic. Published in 1989, with an exceptional design, it immediately won the Coin News award for the best gold coin. It is also the first legal tender issued in Austria, with a pure gold content of 99.99%.

Vienna Philharmonic Gold Bullion Coin

This bullion boasts a long list of prizes. In 1992, it became the best-selling gold coin in the world. Since then the bullion has won the aforementioned title 3 more times. Due to its immense popularity, the Vienna Philharmonic is also available as a silver coin (since 2008) and as a platinum coin (since 2016).

In addition to the Vienna Philharmonic, the Austrian Mint, one of the most important refineries in the world, produces a wide portfolio of collectable bullions, coins and even jewellery. These include the gold coins of the Austrian Duchy, bearing the image of Emperor Franz Joseph. Since 1988, it is also the only institution that produces the currency used in Austria.

Argor Heraeus

Argor has undergone a significant evolution since it was first founded as a Swiss company dedicated to the refinement of precious metals. It is now an essential component of the widely known conglomerate known as “Heraeus Precious Metals,” which trades as Argor-Heraeus. With eleven production facilities and four trading locations, the company conducts business on a global scale while seamlessly integrating a wide range of precious metals-related activities. Production, minting, recycling, trading, and banking are all included in these activities.

The refinery of Argor

For more than 50 years, Argor has led the world in the refinement of precious metals. Here is a brief history of the company’s development:

The founding of Argor as a precious metal refinery in Chiasso, Switzerland, in 1951 served as the company’s catalyst. For about thirty years, it operated independently as the nation’s main refinery for precious metals.

A memorandum of understanding was signed in 2016 between Argor-Heraeus and the United Nations Industrial Development Organisation (UNIDO) to promote environmentally friendly and mercury-free technologies in artisanal and small-scale gold mining and production operations.

Argor changed its name to Argor-Heraeus in 2017, exactly 66 years after it was founded, and became a fully-owned subsidiary of Heraeus Precious Metals. By this point, the business had already started up operations in Chile, Italy, and Germany, solidifying its position as a truly international refiner of precious metals.

Out of stock

Out of stock

Gold bars made by Argor-Heraeus

The German refiner Heraeus keeps acquiring gold while also manufacturing its own brand of cast/minted bars. However, the Argor-Heraeus brand is now used to produce all Argor products. The packaging of the Heraeus bars bears the combined Argor-Heraeus logo, but the bars themselves still bear only the single Heraeus brand name.

They are acknowledged by the LBMA in the UK, which requires a minimum refinery fineness of 995. Argor-Heraeus typically produces to the highest standard of 999.9 fineness, exceeding this benchmark.

As a result, Argor-Heraeus silver bars represent an excellent investment option because they have LBMA approval and are of excellent quality and craftsmanship.

Refineries are honest, right?

Although above we have listed only some of the largest refineries and mines globally, the question remains: “How do we know that refineries offer what they promise?”.

There are a few things to consider in this regard. The first is that in the investment gold business, reputation is everything. Once a company in the industry fails to deliver the quality it promises, it is most likely to be eliminated.

It should also be noted that gold has a specific density of 19.3 grams per cubic centimeter. Thus, even with relatively simple experiments, the gold content of a coin or bullion can be determined. In addition, there are many more scientific ways to verify the amount of gold in bullions. In other words, their products are bought by millions of people every year. It is effortless to detect whether any of these refineries and mines are fraudulent.

Secondly, most of the companies on the list are owned by the central bank in that country. Therefore, it is hard to believe that such an institution could create fraudulent products.

Indeed, Valcambi and PAMP Refineries are not owned by the Swiss Central Bank. However, in their case, extremely strict rules and careful checks provide complete reassurance. It is no coincidence that the refineries have an obligation to include the “Essayeur Fondeur” stamp on all gold products. This stamp certifies that the gold bars and coins have passed an independent inspection by a certified specialist.

Last but not least, all these refineries and mines are part of the international markets. As such, they must meet the requirements of the relevant institutions managing the relevant markets. For example, London traders must meet the requirements of the London Bullion Market Association. The organisation publishes a list of companies known for reliable delivery. The only one missing is the Austrian Mint, which, however, is owned by the local central bank.

In other words, members in the world of gold run through many tests in order to be admitted to the market. In order to prosper, they must constantly improve their services and products. Our partners, the refineries and mints mentioned above, help us to offer you the gold bullion bars and coins we offer at Tavex.