Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

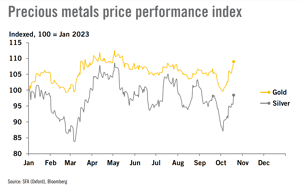

Gold demonstrates surprising strength. Despite record-high Treasury yields, silver remains undervalued - Heraeus

Gold prices have remained near $2000 per ounce despite rising rate hike expectations and skyrocketing Treasury yields, and while silver’s low prices have supported coin sales, the precious metal remains oversold, according to Heraeus analysts.

“Higher than expected US inflation in the previous week and retail sales above expectation last week boosted the odds of the Fed further tightening monetary policy in November,” the economists wrote in their most recent report.

Despite this, gold maintained its momentum from the previous week, rising as high as $1,997/oz.

The Resilience of Gold in the Face of Short Covering and Rising Yields

Some of the rally was likely due to short covering, which was aided further by the escalation of the Middle East conflict motivating haven demand.”

They noted that, despite rising prices, 7.97 million ounces of gold have flowed out of ETFs since the previous peak in May. “It appears that, despite the recent rally in the gold price, investors are more focussed on short-term pain caused by rapidly rising yields rather than opting to bet on potential longer-term gains once this trend reverses,” the researchers wrote. “Gold has made a base above the previous upward trend line which may act as a support for the next few weeks.”

They went on to say that ETF investors could return to gold-backed funds this week “if bearish sentiment shifts to a fear of missing out among institutional investors.”

Despite Market Challenges, Silver Coin Sales Are Increasing

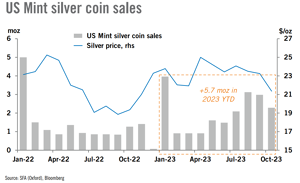

When it comes to silver, analysts say the relatively low price of the precious metal fuelled strong coin sales in the third quarter. “US Mint silver American Eagles were 8.19 million oz in Q3’23, more than double the previous quarter when the quarterly average silver price was 2.6% higher, and also 5.6 moz higher than in Q3’22,” they said in a statement. “Year-to-date cumulative sales (including the first two weeks of October) were 20.2 moz, 5.7 moz (39%) higher than the same period in 2022.” This is despite higher interest rates and a higher opportunity cost of holding physical metal over short-term US Treasury bills.”

Silver Trends in Contrast: Australia’s Drop and Global ETF Movements

The situation in Australia, according to the analysts, was very different, “with bullion sales from Perth Mint seeing a 46% decline in silver product sales quarter-on-quarter in Q3’23, and cumulative sales down 31% year-to-date.”

Silver-backed exchange-traded products fell further, according to Heraeus. “Silver Global silver ETF holdings fell by 6.93 moz (million ounces) (-0.8%) last week, a continuation of the trend set in February this year,” they said, with holdings down 34.5 moz, or 5%, so far in 2023.

The silver price rose less than the gold price last week and the gold-silver ratio sits at around 84.5, which considering the long-term average of 66.25, signals that silver is undervalued relative to gold.

After last week’s late rally, both precious metals are holding at elevated levels, with spot gold last trading at $1,973.05, down 0.40% on the session, while silver has pulled back a little further, with the spot price at $22.987 at the time of writing, down 1.63% today.

Tavex’s comment:

In light of the recent economic events, it’s evident that gold continues to be a resilient asset, holding its ground even amidst rising rate hike expectations and Treasury yields. The metal’s ability to withstand short-term market fluctuations, as indicated by the consistent prices near the $2000 mark, underscores its intrinsic value as a safe haven during uncertain times. The escalating conflict in the Middle East only further solidifies this notion, driving demand as investors seek stability.

On the silver front, the data presents a fascinating dichotomy. While the US has witnessed robust coin sales, likely buoyed by the precious metal’s attractive price point, Australia’s bullion market paints a contrasting picture with declining sales. This geographical discrepancy perhaps speaks to regional economic pressures and investment strategies. The significant drop in silver-backed ETFs globally also signals a broader trend of investor hesitancy or a shift in portfolio strategies. However, the current gold-silver ratio suggests that silver is undervalued in relation to gold, presenting potential opportunities for savvy investors.

Both gold and silver, though experiencing different market trajectories, remain crucial barometers of global economic health and investor sentiment. As the world grapples with fiscal challenges and geopolitical tensions, the precious metals market will undoubtedly continue to be a focal point for analysts and investors alike. As always, a judicious mix of data-driven insights and market intuition will be key to navigating the evolving landscape.

This article is based on an article published by Kitco News.