Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

What is the Difference Between the Term Bullion and Gold

Gold has long been a symbol of wealth and stability, cherished by civilisations across the globe for its beauty and rarity.

In the investment world, gold is often discussed alongside another term: bullion. While these terms are related, they are not synonymous.

This article aims to demystify the difference between bullion and gold, exploring their characteristics, uses, and how they fit into an investment portfolio.

Understanding Bullion

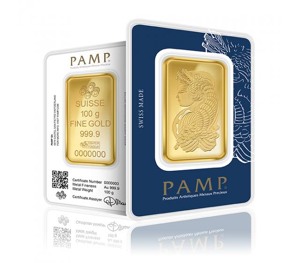

Bullion refers to precious metals in bulk form, intended for trade in the market. These metals can be gold, silver, platinum, or palladium, presented in bars or ingots.

Bullion’s value is primarily based on its metal content and purity rather than its form

In Stock

In Stock

Understanding Gold

Gold is a chemical element with distinct physical properties, including its luster, malleability, and resistance to corrosion. It is used in various industries, from jewellery and electronics to monetary reserves by governments and in the financial market.

Gold in the bullion market comes in forms of gold bars, gold coins, and tends to be high quality pure gold that is seen as a valuable asset class for those looking to invest their money in the long term. Gold in alternative forms may differ in value also based on supply and demand, unlike bullion which is defined off the SPOT price.

Key Differences

While gold can be considered a type of bullion when in bar or coin form, not all bullion is gold

The key differences lie in their form, purity, and investment perspectives.

Form: Bullion is typically in bar, ingot, and coin form, while gold can also be found in coins, gold jewellery, and other decorative items.

Purity: Bullion’s value comes from its purity and mass. Gold items, especially those crafted for decorative purposes, may have lower purity levels. Gold sold as a investment comes with the highest purity of 999.9 gold.

Investment Perspectives: Investing in bullion is often seen as a hedge against inflation and economic uncertainty. This is unlike other assets where their value fluctuates in the short term based on the stock market and interest rates, such as exchange traded funds (ETFs). Gold, particularly in forms other than bars or coins, may carry additional value due to its historical and cultural significance.

In Stock

In Stock

Why Choose Bullion Over Gold

Bullion is prized for its market stability, liquidity, and straightforward valuation based on current market prices.

Gold prices are renowned for being very stable throughout economic uncertainty, providing stability in your investment

Gold in other forms, such as jewellery, may not be exempt from the same taxes that gold bullion is. Some forms of gold bullion, such as coins minted by The Royal Mint, are exempt from Capital Gains Tax (CGT) which makes it favourable when coming to selling gold.

Why Gold May Be Preferable

In some situations, the cultural significance of gold and its potential as a collecting object might make it a more desirable investment. Alternative prices of gold might be more alluring, particularly for investors who desire a variety of uses for their money.

Conclusion

It is essential for every investor trying to diversify their portfolio with precious metals to understand the distinction between bullion and gold. Through acknowledging the distinct characteristics and investment possibilities of each, people are able to make well-informed choices that correspond with their financial objectives and risk appetite.

Key Takeaways:

- Bullion as a Trade Commodity: Bullion, encompassing gold, silver, platinum, or palladium in bars, ingots, or coins, is valued for its metal content and purity. Its appeal lies in its straightforward market valuation, liquidity, and role as a hedge against inflation and economic fluctuations.

- Gold’s Versatility and Cultural Value: Beyond its use in bullion, gold can be found as jewellery, décor, and coinage. It combines aesthetic appeal, cultural significance, and financial return. Although gold has an irresistible physical appeal, its value as an investment goes beyond its material attributes since it represents a rich cultural and historical legacy.

- Strategic Investment Insights: Several factors influence whether to invest in bullion rather than gold, or vice versa. These comprise the goals of the investor, their tolerance for risk, and the ideal ratio of stability to appreciation potential. Bullion is a desirable option for simple value preservation since it provides market stability and is exempt from some taxes. In all its forms, gold offers chances for collectibility, diversity, and interaction with a wider range of market dynamics.

- Navigating Investment Choices: Investors are advised to do extensive research in market trends before deciding between the versatile attraction of gold and the dependable stability of bullion. This guarantees that you accept the concept of portfolio diversity and remain up to date on market movements. This strategy reduces market volatility risks while simultaneously increasing the possibility of financial gain while buying and selling.

FAQs

1) How do I verify the purity of gold or bullion?

Authenticating gold bars is essential for any investor. By applying these methods, and fact checking against industry standards you can ensure the integrity of your gold investment. To learn more about ensuring your gold bullion is real, read more here.

2) What are the tax implications of investing in gold or bullion?

Gold has many appealing tax advantages including being VAT free and CGT free. To learn more about tax and gold, read more here.