Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Understanding the Weight Significance in Gold Bullion

Gold, a symbol of wealth and sophistication for centuries, remains a highly valued commodity in various forms, notably bullions. This article explores the intricate details of gold bullion, focusing on its weight and how it impacts its value and market position.

What is Gold Bullion?

Gold Purity and Fineness

Gold bullion, traded and valued for its weight and purity, is found in bars, ingots, or coins. Its purity, often between 99.5% to 99.99%, is indicated by its fineness, ensuring authenticity and quality.

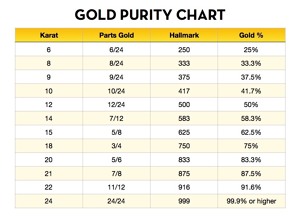

The Gold Carat System

The carat system measures the ratio of pure gold to other metals in gold alloys, crucial in jewellery. Higher carat numbers indicate higher gold content, affecting the bullion’s value.

Understanding Gold Fineness

Fineness represents gold purity in parts per thousand. For instance, a gold piece marked 750 fineness would be 75% gold.

Background: Measurement of Gold Mass

Troy Ounce: The Standard

Gold is measured in troy ounces, slightly heavier than the standard avoirdupois ounce. The troy ounce is vital for accurate pricing and trading in gold bullion, which is typically made from 99.9% pure gold.

Grams: The Alternative Measure

Alternatively, gold can also be measured in grams, with smaller sizes like 1-gram bars being more expensive due to the rarity of gold.

How Weight Influences Gold Price

The value of gold bullion is significantly influenced by its weight, which interacts with other factors such as market price and purity to determine its overall worth.

This relationship between weight and value of gold bullion is multifaceted and plays a crucial role in the investment and trading of gold.

Weight and Market Dynamics

Gold bullion is typically traded in weight units like troy ounces or grams. The market price of gold, usually quoted per troy ounce, directly affects the value of gold bullion. As the weight of the gold increases, the overall value of the bullion also rises, assuming a constant market price.

This correlation means that larger bars, such as those weighing a kilogram, inherently carry a higher value than smaller bars or coins due to their greater gold content, highlight gold weights significance.

Purity as a Compounding Factor

The purity of gold, often measured in fineness or carats, is another critical factor that compounds with weight to determine value.

For instance, a one-ounce bar of 99.99% pure gold is more valuable than a one-ounce bar of 99.5% pure gold. This purity, when combined with the weight, amplifies the value of the gold bullion.

Economies of Scale in Pricing

There’s an economy of scale in gold bullion pricing.

Larger gold bars typically have lower premiums over the spot price of gold compared to smaller bars or coins.

This is due to the lower production costs per ounce when producing larger bars.

As a result, investors buying larger, therefore heavier, bars get more gold for their money, making these bars a more cost-effective investment option in terms of the price per ounce of gold.

Liquidity and Market Demand

The weight of gold bullion also influences its liquidity. Bullion products such as smaller bars and coins are more accessible to individual investors and are easier to sell, making them highly liquid, while also being considered a safe haven asset.

Larger bars, while offering more gold value, may not be as liquid due to the smaller market of buyers capable of purchasing them. This liquidity factor can influence the premium over the spot price, influencing investment decisions.

Storage and Security Considerations

Heavier gold bullion, like kilo bars, requires more storage space and enhanced security measures, which can be a consideration for investors.

The costs associated with secure storage and insurance for larger amounts of gold can impact the net return on investment.

Key Takeaways

In the realm of gold bullion, weight is not just a physical measure, but a key determinant of value, liquidity, and investment viability. This article has highlighted how the weight of gold, influenced by factors like purity and market dynamics, impacts its pricing and practical considerations for investors.

Smaller gold pieces offer higher liquidity, while larger bars, with lower premiums, provide more gold per unit cost. However, these come with considerations for storage and security. Understanding these nuances is crucial for anyone engaging with gold, be it for diversification, gold investment, or admiration of its enduring appeal.

In essence, the weight of gold bullion encapsulates its historical and economic significance, making it a pivotal factor in the precious metals market.