Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

The Investment Potential of 100g Gold Bars

Gold has traditionally been a popular asset among investors looking for stability and security. The 100g gold bar, in particular, is a wise investment since it combines price, quality, and flexibility. These bars are a cost-effective investment because of their lower manufacturing costs relative to their overall value.

Top refiners create 100g gold bars, which are known for their high quality and purity, ensuring a reliable and useful addition to investment portfolios. Furthermore, they create a balance between the liquidity of smaller bars and the value of larger bars, making them an excellent choice for both beginner and seasoned investors.

This article delves into the advantages of 100g gold bars and explores various options available, including ‘best value’ bars, branded bars, and tax-free gold coins, offering insights for those considering gold as an investment.

Why Choose 100g Gold Bars?

Cost-Effectiveness

One of the most compelling reasons to invest in 100g gold bars is their cost-effectiveness. When compared to smaller or larger gold bars, 100g bars strike a balance between affordability and substantial investment.

The manufacturing cost, which is a significant component of the price, is much lower as a percentage of the overall price for 100g bars than for smaller bars. This makes them a more cost-effective choice for investors looking to maximise their investment in gold.

Quality and Purity

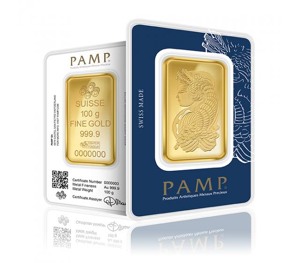

100g gold bars are known for their high quality and purity, typically 24 carats of gold content with a purity of 999.9. They are manufactured by some of the world’s best-known refiners, including Heraeus, Umicore, UBS, Perth Mint, Credit Suisse, Pamp, Bairds, and Metalor. This ensures that investors are getting a product of the highest standard.

Investment Benefits

Gold is a tangible asset that offers stability in times of economic uncertainty in the long term.

Historically, gold has maintained its value and has been a hedge against inflation and currency devaluation. Investing in gold bars, particularly the 100g size, can be an excellent way to diversify your investment portfolio and protect against financial volatility.

The Best Value 100g Gold Bars

The concept of ‘best value’ 100g gold bars is an attractive option for those seeking high-quality gold at a lower price.

These bullion bars are typically sourced from excess stock, meaning they are sold at a lower price than if you were to select a specific brand. Despite the lower cost, they still offer the same high purity and quality as branded bars.

Expert Opinion on 100g Gold Bars

Experts, such as financial advisors, often cite the 100g gold bar as the ‘sweet spot’ in gold bullion investment. Its size offers a perfect balance between value and manageability.

While larger bars, like 500g or 1kg, might offer a slightly lower gold price per gram, they lack the flexibility and liquidity provided by smaller bars that may be more suitable in the short term when considering buying or selling your gold. With 100g bars, you have the option to sell part of your holdings without having to liquidate a larger investment.

Alternatives to Best Value 100g Gold Bars

Branded Gold Bars

For those who prefer a more branded option, products like the Metalor 100g Gold Bar offer a guarantee of Swiss quality in a sealed, tamper-proof packet.

While slightly more expensive, they provide assurance of brand and quality, making them appealing asset class when considering investment strategies.

Tax-Free Gold Coins

Another alternative to consider is tax-free gold coins, such as Sovereign coins or British Britannias, which offer divisibility and tax advantages.

While gold bars are VAT exempt, UK gold coins are also Capital Gains Tax-free, allowing you to keep all your profits while still diversifying your portfolio. Tax-free coins of 1 troy ounce are also considered a lucrative investment that could be considered for budding investors.

Key Takeaways

Investing in 100 g gold bars can be a wise decision for those looking to diversify their investment portfolio in the bullion market and create a balanced portfolio with a stable, tangible asset.

With their balance of cost-effectiveness, quality, and flexibility, 100g gold bars offer a unique opportunity for both new and seasoned investors.

As with any investment, it is always recommended to conduct thorough research and consider your financial goals and preferred type of investment before making a decision.