Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Investing in Precious Metals: Alternatives to Gold Investments

When it comes to investing in precious metals, gold is the first thing that comes to mind for most investors. In fact, gold is considered by many experts to be a “safe haven” in uncertain times and is particularly sought after when fears of monetary devaluation increase.But you can’t just invest in gold as a precious metal.Silver, platinum, palladium and rhodium are also popular precious metals that often lie in gold’s slipstream.We show how to invest in precious metals, which precious metals are selectable and which factors affect returns.

What are precious metals and what are there besides gold?

Precious metals are metals that are very stable and resist corrosion. They do not react, or only to a very small extent, with water or air at normal temperatures – in contrast to iron, which begins to rust on contact with water. All precious metals are heavy metals – i.e. metals with particularly high density and corresponding weight.

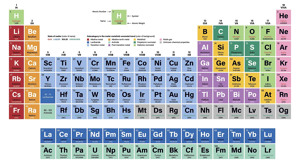

Precious metals include gold (Au), silver (Ag) and the platinum metals. In addition to platinum (Pt), there are some other metals that are “close to platinum” in the chemical periodic table – especially in the 5th and 6th periods and in groups 8 to 10. These are ruthenium (Ru), rhodium (Rh) , palladium (Pd) and osmium (Os) as well as iridium (Ir).

Common to all precious metals is that they occur very rarely in nature. Since ancient times, gold and silver have therefore been the most sought after raw materials. Both precious metals have been used to mint coins and make jewellery for thousands of years. Platinum has not been very popular throughout the ages, but more recently it has been valued as a valuable material for jewellery and coinage.

Platinum is particularly sought after due to its good properties for high-quality industrial use. This also applies to the platinum metals palladium and rhodium.

Good to know: Gold, silver and platinum have established themselves as commodities in the financial markets.

What factors determine the development of the prices of precious metals?

As in all markets, the price of precious metals is governed by supply and demand. The supply is determined on the one hand by the quantities that are extracted and on the other hand by the stocks of precious metals that are offered for sale.

Various factors are relevant to the demand: the need for jewellery manufacturing and industrial use, speculative considerations and the desire to secure assets and invest in tangible assets with “stable value”. Precious metals are often considered safer than cash. Gold in particular has always been sought after as a financial investment.

This is also due to the fact that for a long time it had a central importance in monetary policy. Until the end of the so-called Bretton Woods system in the 1970s, the most important currencies were still indirectly linked to gold via the dollar. This gold link no longer exists. Despite this, almost all central banks still hold larger gold reserves as disposable foreign exchange reserves. Therefore, the central banks’ gold policy always has a certain significance for the gold price.

Often the price of gold indicates the direction of the prices of the other precious metals. If the gold becomes more expensive, the prices of the other precious metals also rise and vice versa. However, this is not a law of nature. The individual precious metal markets follow their own rules and the relationship between the respective precious metal price and the gold price can fluctuate greatly.

Important to know: The gold price and other precious metal prices are usually quoted per troy ounce. The mass in troy ounce corresponds to the apothecary ounce (1 ounce = 31.1034768 g) and always refers only to the precious metal content in pieces of metal, for example in gold bars or in gold coins.

How to invest in precious metals?

Anyone who wants to invest money in precious metals will first come across classic precious metal investments in physical form by buying bars or coins. For gold and silver, one can find many offers in from well-established myths, but investors have to search comparatively further for platinum, palladium or even rhodium bars. Gold, silver and platinum are the most common coinage metals. When it comes to physical investments, however, there is always the question of safekeeping.

In the meantime, however, there are alternatives to classic investments in physical form. With securities, investors can include various precious metals in their portfolio.

Take a look at our range of gold and silver here!

ETCs (Exchange Traded Commodities) with precious metal reference

These are exchange-traded certificates whose development is linked to specific commodity prices. As a rule, they replicate the spot price. Precious metal ETCs are an alternative to physical purchase of precious metals, but they are also associated with risks. Like all certificates, ETCs can suffer losses, up to and including a total loss.

Meanwhile, investors can also find shares in companies involved in mining or trading precious metals. However, the corresponding shares do not necessarily move at the same pace as the precious metal and can fluctuate more strongly in price. This creates a serious risk for investors. The shares fluctuate a lot depending on several factors such as investments, discoveries of new places to dig etc.

Investment funds with precious metal shares and precious metal ETFs in the portfolio

Investors can now also find many active and passive funds with precious metal exposure. The funds follow the principle of risk diversification and invest in a majority of precious metal-oriented shares or replicate the corresponding index. Active funds, on the other hand, try to outperform their benchmark, while passive ETFs limit themselves to replicating as closely as possible.

However , precious metal ETFs that track pure precious metal prices are not permitted in the EU. Even with active and passive funds with a precious metal benchmark, investors must expect losses due to volatility.

CFDs and other derivatives with precious metals as underlying assets

CFD contracts (Contracts for Difference) are highly speculative instruments that react sensitively to small price changes and are used by trading experts. In addition, there are a number of other derivatives for precious metal speculators, e.g. warrants, leveraged certificates or other speculative structures. However, such instruments are not suitable for long-term investments and are very risky.

Advantages and disadvantages of investing in precious metals

Anyone who wants to invest money in precious metals should research the advantages and disadvantages of a precious metal investment.

Benefits

- Precious metals are valued by many experts as a crisis-proof investment opportunity.

- In the case of precious metals, retail investors can invest not only in securities but also in physical property.

- Investment experts use investments in precious metals to diversify the portfolio, since the price trends of the various investments usually do not run in parallel.

Disadvantages

- No investment is crisis-proof – even precious metals can be subject to strong fluctuations and can in very few cases lead to large losses.

- Physical assets must be stored securely. This usually incurs additional costs.

- Despite their reputation as ‘safe havens’, precious metals are subject to regular and sometimes sharp fluctuations in value. Due to the high volatility, investments in precious metals are can also be considered risky investments.

What should I consider when investing in precious metals?

Unlike interest-bearing investments or shares, pure precious metal investments do not provide an ongoing return . The return is based exclusively on the price trend. In times of low interest rates, this classic disadvantage of investing in precious metals has become relative, but it still remains.

Precious metals may under certain circumstances offer a possible persistence of value and a possible “real” value preservation effect, especially in the long term, but there is no guarantee of this.

Given the illusions of some investors, we caution against fundamentally viewing precious metals as an investment with a high degree of certainty. Precious metal investments are above all a risky and speculative investment. Speculating on a certain price trend is a clear risk – not only because prices fluctuate widely, but also because they are subject to a high degree of forecast uncertainty. Even recognized experts are often wrong in their predictions about the value development of precious metals.