Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Comparing the iPhone's Cost Evolution Using Gold as a Benchmark

Traditional measures of value often revolve around currencies like euros or dollars. However, in a world that’s constantly evolving and with currencies susceptible to inflation and political influences, it’s interesting to explore alternate modes of value assessment.

One such method is by comparing products, services, and precious metals like gold. One fascinating comparison is understanding how the price trajectory of the iPhone has evolved when measured against the gold standard.

Why Compare the iPhone to Gold?

Gold has long been considered a stable measure of value. It’s scarcity, longevity, and universal acceptance make it a unique benchmark to measure the value of other assets.

Historically, gold has maintained its value over time, serving as a hedge against inflation and a safe-haven asset during times of economic uncertainty.

iPhone’s Rising Cost: A Brief Overview

Any iPhone enthusiast would confirm that the smartphone’s price tag has been on an upward trajectory.

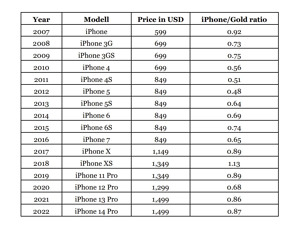

From its introduction in 2007 with the debut model priced at $599, the iPhone’s cost has soared by 150%, with the iPhone 14 in 2022 boasting a hefty price of $1,499. This sharp rise translates to an average annual price growth of 6.3%.

While the iPhone’s dollar price has risen significantly, its cost in euros presents an even steeper incline.

What is the reason for this?

The euro has seen consistent depreciation against the dollar since 2007. This currency fluctuation has inadvertently made the iPhone more expensive for European consumers, even if its gold-measured value remains relatively consistent.

The iPhone/Gold Dynamics

For people who appreciate the elegance of both the iPhone and the timeless allure of gold, the price evolution presents a captivating story.

In 2007, purchasing the pioneering iPhone would require a trade of 0.92 ounces of gold. Fast forward to 2022, the iPhone 14 Pro’s price equivalency is at 0.87 ounces of gold.

Figure 1: iPhone/Gold Ratio

In essence, despite the fluctuations and economic dynamics over the years, the iPhone’s value, when measured in gold, has remained relatively stable. This suggests that while fiat currencies can be volatile, gold remains a steadying force.

While the nominal price of the iPhone has seen a significant increase over the years, especially when considering currency fluctuations like the depreciation of the euro against the dollar, its value when measured against the stable benchmark of gold has remained relatively consistent. This comparison underscores gold’s enduring value and stability in the face of economic fluctuations and highlights the utility of using alternative measures like gold to assess an asset’s worth over time.

As the world grapples with economic fluctuations, the iPhone-gold relationship offers an intriguing perspective on understanding value. It’s a testament to how alternate measures can sometimes provide a clearer, more stable view of an asset’s worth over time.