Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Circus around US debt points to a flawed monetary system

The US public debt limit (the amount the government is allowed to borrow) was reached again last Thursday, forcing the Treasury to take extraordinary measures to avoid a sovereign default. Treasury Secretary Janet Yellen said that a failure to reach an agreement on raising the debt ceiling could lead to a global financial crisis.

Republicans, who have a slight majority in the House of Representatives, insist that any increase in the debt ceiling must be linked to spending cuts. The White House has resisted this and has announced that no concessions will be made to raise the debt ceiling. Resolving the debt ceiling drama is in the hands of Congress, and there are growing fears that neither party will concede. This would mean that for the first time in history, the US would default on part of its national debt.

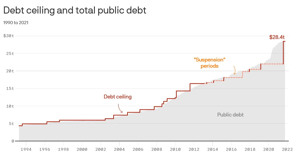

The US debt ceiling stands at $31.4 trillion and has been steadily increased over the years. Last week, however, that limit was breached and Treasury Secretary Janet Yellen said the government would have to take extraordinary measures to keep the public finances running. These measures will run until 5 June this year.

Default could lead to global financial crisis

This will give Congress time. However, the duration of the extraordinary measures is “uncertain”, Yellen said, and predicting how big the government’s liabilities will be in the coming months is very difficult.

If the extraordinary measures are exhausted and Congress fails to raise the debt ceiling, the US credit rating will certainly be downgraded. Ultimately, the situation could lead to a global financial crisis, according to Yellen.

US debt ceiling (in red, in trillions of dollars) and US national debt (in grey).

“If that happens, our borrowing costs will go up, and so will the borrowing costs of all Americans,” Yellen said. “There is no doubt that a suspension of payments to creditors, welfare recipients or the military would cause a recession in the US. Potentially, a global financial crisis could follow.”

“It would also undermine the dollar’s status as a reserve currency in the world, dollars are used all over the world. And Americans – a lot of them would lose their jobs and certainly their borrowing costs would rise.” Yellen continued.

Tavex’ comment:

The debt ceiling in the US is a very strange formation. It has been raised dozens of times since 1970, but it has never been lowered.

It is no coincidence that the debt ceiling has only been raised. In a monetary system with an unbacked currency and based on debt, it is not possible to consistently lower the debt ceiling. The monetary system depends on the growth of debts in the economy, every dollar created is put into circulation with interest. Currency and debt act like matter and antimatter – when they come into contact, both are destroyed. Interest, however, remains. In order to pay this interest, new currency needs to be lent into circulation.

Of course, not all the money will come into circulation when the US national debt is increased. Most of the money comes from fractional reserve banking. However, these loans also carry interest, and when repaid, the principal of the loan disappears from circulation.

So the debate around the debt ceiling is a complete circus. Both sides know that the debt ceiling will eventually have to be raised because it is absolutely unavoidable. Neither the Democrats nor the Republicans want to see the US default – that would create a whole host of problems far greater than the concessions required of the other party.