Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Benefits of Investing in 5g Gold Bars

Among the various forms of gold investment, 5g gold bars offer a unique combination of affordability and value. This makes them an attractive option for investors.

This article explores the benefits of investing in 5g gold bars, offering insights into why they are a wise choice for those looking to diversify their investment portfolio.

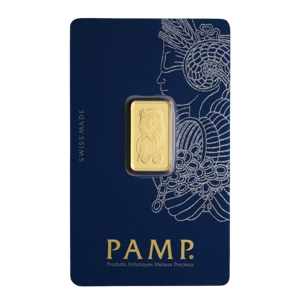

Understanding 5g Gold Bars

5g gold bars refer to gold bars that weigh 5 grams

They are a popular choice among investors due to their small size, which makes them more accessible and easier to trade compared to larger gold bars or coins. Crafted in 24 karat gold, 5g gold bars make it an ideal asset when looking at types of investments among the precious metal market.

In Stock

In Stock

Why Invest in Gold?

Gold, as an asset class, is known for its stability and ability to retain value in the long term, making it a safe haven during economic uncertainty. Its value is recognised globally, and it serves as a hedge against inflation and currency devaluation, lowering its level of risk as an asset.

Advantages of 5g Gold Bars

Portability and Storage

The compact nature of 5g gold bars means they can be easily stored in a home safe, a bank deposit box, or even securely transported, providing investors with both flexibility and security in managing their assets. Additionally, established mints such as The Royal Mint, provide storage options for customers.

Affordability

5g gold bars lower the entry barrier to gold investment, allowing individuals to allocate a portion of their savings towards gold without necessitating a large upfront investment. This affordability also enables investors to gradually build their gold holdings over time.

In Stock

In Stock

Liquidity

Gold’s global acceptance ensures that 5g bars can be easily converted into cash, offering liquidity that is often superior to other investment vehicles. This liquidity is particularly valuable in times of financial emergency, where access to quick funds can be crucial. The size of this gold bar makes the buying and selling a lot easier and quicker, and malleable around different market conditions.

Low Risk of Counterfeit

The meticulous manufacturing and certification processes behind 5g gold bars minimise the risk of counterfeiting. Investors can rest assured of their purchase’s authenticity, especially when opting for bars from reputable mints and dealers.

Diversifying Investment Portfolio

Including gold in your portfolio as a longer-term investment asset can assist reduce portfolio risk

Gold is a non-correlated asset type that can be used as a hedge against inflation and currency risk when added to an investment portfolio. Adding 5g gold bars, in particular, can improve portfolio diversification by reducing overall risk without compromising possible rewards through a diversity of asset allocation in a secure investment.

How to Invest in 5g Gold Bars

Investing in 5g gold bars requires due diligence in selecting a dealer. Look for businesses with established reputations, transparent pricing, and strong customer service. This can safeguard against fraud and ensure a positive investment experience.

Out of stock

Out of stock

To ensure the legitimacy of your investment, opt for 5g gold bars that come with a certificate of authenticity. Additionally, purchasing bars from well-known mints can further guarantee their quality and resale value.

A successful investment strategy involves staying informed about the gold market’s fluctuations. Knowledge of market trends and timing purchases can enhance investment returns and mitigate potential losses.

Book a free consultation with one of our precious metals experts at Tavex, to discuss investment options.

Potential Risks and How to Mitigate Them

While generally stable, gold prices can be subject to short-term volatility. Diversifying your investment portfolio and adopting a long-term investment horizon can help smooth out these fluctuations and reduce risk. Gold is much more stable in the long term than other assets that are tracked against the stock market and interest rates.

Securing your gold investment requires thoughtful consideration. Opting for insured storage solutions, whether at home or in a bank vault, can protect against theft or loss, preserving your investment’s value over time.

Takeaways

- Investing in small gold bars, like 5g options, offers a strategic way to diversify investment portfolios, combining affordability with tangible value. Their portability and ease of storage, alongside the global stability of gold as a hedge against inflation, make them a secure and accessible choice for investors. The ability to easily convert these bars into cash enhances their liquidity, providing financial flexibility when needed.

- Ensuring quality and reducing the risk of counterfeiting, strict certification protects the integrity of these assets. This results in a lower barrier to entry for gold investments and a chance for investors to reduce total investment risk while pursuing consistent profits.

- Maximising the potential of small gold bars requires selecting trustworthy dealers and keeping up with industry developments. A wise decision for anyone looking to improve their financial position in a volatile market is to store your investment securely and think about getting insurance.

- When considering investing in gold bars take consideration of your personal risk tolerance, and your desire for your investment (e.g rate of return, and if you are wishing for higher returns). If you are unsure, do feel free to contact a financial advisor to seek advice on what size gold bar may suit your needs.

FAQs

1)Are 1g gold bars worth investing in?

Adding 1g gold bars to your investment portfolio is a wise strategy to increase the value and liquidity of the asset. Affordability, simple liquidity, sustained value retention, and efficient inflation hedging are all provided by the bullion market. Read more about why investing in 1g gold bar could be a good addition to an investment portfolio here.

2) What other sizes do gold bars come in?

Gold bars come in various sizes, each with its own unique investment potential. Learn more about different size bars to make informed decisions when buying gold bars here.