Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

8 Common Myths About Investing in Gold

Investing in gold has long been considered a prudent strategy for diversifying investment portfolios and preserving wealth. However, there are several myths surrounding gold investment that may deter potential investors. Let’s debunk these myths and shed light on the positive aspects of investing in gold.

Myth 1: You Have to Be Wealthy to Invest in Gold

Contrary to popular belief, you don’t need to be wealthy to invest in gold. With fractional ownership options, investors of all budget sizes can participate in the gold market. Gold bullion coins come in a range on denominations ranging from a 1oz gold coin costing £1,848.60, to 1/20oz gold coins costing £184.85 (please note these prices are based off the SPOT price on 24th April 2024)

Fractional ownership products allow individuals to invest in small amounts of gold, making it accessible to a wider range of investors.

Read more on the topic here: Fractional Coins

In Stock

In Stock

Myth 2: Investing in Gold is Risky

Investing in gold is often perceived as risky, but it’s important to recognise gold’s role as a hedge against market volatility, unlike other assets on the stock market.

During times of economic uncertainty or geopolitical instability, gold prices tend to rise, providing stability to investment portfolios. By incorporating gold into their portfolios, investors can mitigate risk and protect against market downturns.

Myth 3: Investing in Gold is Not Liquid

Gold markets are highly liquid, offering investors the flexibility to buy and sell gold quickly and easily

Through physical bullion investors can access gold markets with ease. This liquidity makes gold an attractive investment option for those seeking to maintain flexibility and capitalize on market opportunities.

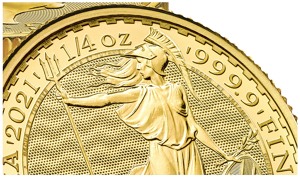

Additionally, by purchasing gold bullion in smaller denominations it makes your investment extremely liquid, allowing you to cash in your investment in smaller amounts. For example, the Gold British Britannia Coin produced by The Royal Mint comes in denominations of 1oz, 1/2oz, 1/4oz, 1/10oz and 1/20oz.

Myth 4: Gold Pays No Interest or Dividends

While gold may not pay interest or dividends like traditional investments, its value lies in its ability to preserve wealth over time.

Unlike fiat currencies, which can be subject to high inflation and depreciation, gold retains its purchasing power and increasing market price over the long term. By holding gold, investors can safeguard their wealth and protect against currency devaluation and reinforce their own personal economic growth.

Myth 5: Gold Prices Will Fall if Interest Rates Rise

Contrary to popular belief, gold prices do not necessarily fall when interest rates rise. Historical data suggests that gold prices can rise or remain stable in environments of higher interest rates.

Gold’s value is influenced by a multitude of factors, including inflation expectations, currency movements, and investor sentiment, making it a versatile asset for all market conditions.

Myth 6: Gold is Hard to Buy and Store

While it may seem hard to invest in gold, that is actually not the case. Many gold dealers, such as Tavex, have an online platform and a in person location. This means you can order your gold online straight to your house, or you can come in and see and collect the gold in person.

Effectively storing gold can be simple with the proper approach

Investors have various options, including utilising bank safety deposit boxes, secure home safes, or opting for professional storage services provided by gold investment companies. The crucial aspect is selecting a storage method that prioritises security and provides assurance for peace of mind.

Myth 7: Mining Stocks are Better Than Gold

While mining stocks can offer exposure to gold prices, direct ownership of gold provides unique benefits that cannot be replicated by stocks, gold etf, or exchange traded funds (ETFs) in that case.

Unlike mining stocks, which are subject to company-specific risks and market fluctuations in stock prices, gold itself serves as a tangible store of value. By investing directly in gold, investors can hedge against systemic risks and benefit from its intrinsic value.

Read more on the topic here: Gold Mining Stocks vs Physical Gold as an Investment

Myth 8: Cash is Better to Hold Than Gold

Gold has served as a currency and legal tender for millennia, with its use dating back to at least 700 BC. However, in the contemporary world, this is no longer the norm. Nowadays, almost all currencies are fiat-based, devoid of intrinsic value, and reliant solely on the faith and confidence of the people in their worth.

However, recently Zimbabwe has announced its move back to a gold-backed currency. Could this be a new trend into the future. Read more about this here.

While cash may offer short-term liquidity, it can be eroded by inflation and currency devaluation over time

Gold, on the other hand, has a long-standing track record as a reliable store of value. During periods of economic uncertainty or currency instability, gold serves as a safe haven asset, preserving purchasing power and safeguarding wealth against depreciation. This can also be seen among central banks who hold a significant reserve of gold.

Conclusion

In conclusion, debunking the prevalent myths surrounding investing in gold sheds light on its significant advantages as a wise investment choice. Despite common misconceptions, gold stands as an accessible and beneficial asset class.

By dispelling the notion that substantial wealth is necessary for gold investment, fractional ownership options open doors for investors of all financial backgrounds. It is important to understand these myths as this inclusivity broadens access to the gold market, making its benefits attainable to a wider audience.

Furthermore, recognising gold’s role as a hedge against market volatility emphasises its stabilising influence on investment portfolios. Contrary to perceived risks, gold offers stability during economic uncertainty, shielding against market downturns.

Dispelling concerns about gold’s liquidity underscores its ease of acquisition and sale, providing flexibility for investors. Moreover, understanding gold’s value in preserving wealth over time highlights its resilience against inflation and currency devaluation, ensuring long-term financial security.

The bottom line is that dispelling these myths illuminates the undeniable advantages of gold investment, urging investors to consider its role in diversifying portfolios and safeguarding wealth, even if it is just starting with one ounce of gold!