Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

5 Reasons Why People Are Investing in Gold in 2024

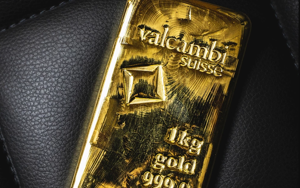

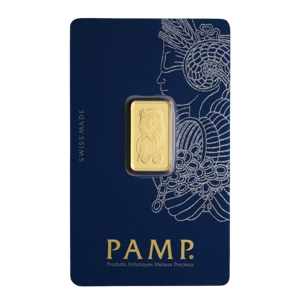

Gold has hit a new all time climbing to $2,295 in April 2024. Recently, investing in gold has attracted a lot of attention, and for good reason. Inflation is not the only factor affecting the value of the dollar; other economic issues such as high interest rates and market volatility are also contributing to economic uncertainty. Additionally, investors often look to add safe assets to their portfolios, like gold, during uncertain economic times.

Gold investing has been a fundamental aspect of financial markets for centuries. As one of the oldest forms of currency and a symbol of wealth and prosperity, gold continues to capture the interest of investors worldwide.

Understanding the reasons behind why people invest in gold can provide valuable insights into its enduring appeal and its role within diversified investment portfolios.

1) Hedge Against Inflation

Inflation, the gradual increase in the prices of goods and services over time, erodes the purchasing power of fiat currencies. Gold has historically served as a hedge against inflation because of its intrinsic value and limited supply.

When inflation rises, the value of gold tends to increase, preserving wealth and purchasing power for investors

The World Gold Council reported that in 2022, despite significant inflation, gold prices increased by 0.4% based on Bloomberg statistics. By contrast, S&P Dow Jones Indices reports that the S&P 500 index, which is frequently utilised as a stand-in for the US stock market, had a negative correlation and fell by about 20% in 2022.

Even if the rate of inflation is much lower now than it was when it peaked in the middle of 2022, it still affects us in the short term as well as long term. The Federal Reserve’s target inflation rate of 2% is still higher than the most recent inflation report, which was released in January. This may be contributing to the increase in gold market prices.

Read more on the topic here: The Federal Reserve

2) Portfolio Diversification

Diversification is a fundamental principle of investment strategy aimed at reducing risk by spreading investments across different asset classes, to make a portfolio as risk free as possible.

Gold offers diversification benefits as it tends to have a low correlation with other financial assets such as stocks and government bonds

By including this precious metal in their portfolios, investors can potentially improve risk-adjusted returns and mitigate downside risk.

Read more on the topic here: The Importance of Investment Diversification

3) Global Economic Stability

The global economy is subject to various macroeconomic factors such as interest rates, currency fluctuations, and geopolitical tensions, all of which can impact financial markets.

During times of economic instability, gold tends to outperform other assets as investors flock to its perceived safety. Its status as a universal store of wealth makes it particularly attractive in times of crisis, reinforcing its role as a strategic investment choice.

For example, in the first week of October 2023, the Palestinian resistance group Hamas fired 5,000 rockets into Israeli territory, in an unprecedented series of strikes on Israel. After then, the price of gold started to increase swiftly, reaching $1,861 the following trading day, up 1.6 percent. The price of an ounce rose further in the days that followed, hitting $1,947 a week and a half after the assaults.

More on the topic here: How does geopolitical events influence the price of gold?

4) Safe Haven Asset

During times of economic uncertainty or geopolitical instability, investors seek safe haven assets to protect their wealth from market volatility.

Gold, often referred to as the “ultimate safe haven asset,” has a proven track record of retaining its value during periods of crisis. This is no different in 2024. Its tangible nature and universal acceptance make it a preferred choice for investors looking to safeguard their assets.

For example, gold has exhibited this trend in 2008. During the 2008 financial crisis, the price of gold increased significantly as investors sought a safe haven asset to protect their wealth from the effects of the recession. While stocks and bonds, and other financial instruments such as exchange traded funds (ETFs) were plummeting in value, gold remained a stable and reliable investment, providing a sense of security for investors and central banks.

5) Store of Wealth

Gold has long been recognised as a reliable store of value due to its durability, scarcity, and intrinsic beauty. Unlike fiat currencies that can be subject to depreciation through inflation or government policies, gold maintains its purchasing power over time.

As a tangible asset with inherent value, gold provides investors with a sense of security and stability in uncertain economic environments.

Read more on the history here: The History of Gold and Silver as a Store of Value

Key Takeaways

Over periods of time, gold has demonstrated its value as a worthwhile investment, particularly in 2024 when it surged to $2,295, new all-time highs. There are a number of reasons for this increase in interest in gold investments. The allure of gold as a financial risk hedge and safe haven investment has been highlighted by inflation as well as other economic worries including high interest rates and market volatility.

Furthermore, the enduring allure of gold as a safe haven asset continues to attract investors seeking stability amid economic turbulence. Its role as a store of wealth remains unchallenged, bolstered by its intrinsic value, scarcity, and universal acceptance.

Portfolio diversification remains a key strategy for investors, and gold’s low correlation with traditional financial assets offers a compelling reason to include it in investment portfolios. Additionally, global economic stability concerns, fuelled by geopolitical tensions and currency fluctuations, further enhance gold’s appeal as a strategic investment choice.

The recent history of gold prices following significant geopolitical events, such as the example of Hamas rocket attacks in 2023, highlights the metal’s responsiveness to crises, solidifying its reputation as a safe haven asset.

In conclusion, the bottom line driving people to invest in gold in 2024 are multifaceted and underscore the metal’s enduring relevance in investment strategies. Whether as a hedge against inflation, a diversification tool, a safe haven asset, or a store of wealth, gold continues to attract investors seeking stability and long-term value preservation in uncertain economic times.