Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Why Does the Value of Gold Change Differently in Different Currencies?

Gold, the yellow metal, has been mankind’s treasure for centuries. It’s been the backbone of economies, the mark of wealth, and often a thing of beauty. But have you ever wondered why its value is never constant across different currencies?

In the realm of economics and finance, few commodities hold as much allure and historical significance as gold. This precious metal has been a symbol of wealth and a form of currency for thousands of years. However, in our modern economy, the value of gold is not a fixed monument; it is a dynamic entity that ebbs and flows across different currencies.

The question that arises is: Why does the value of gold change in different currencies?

A Brief History of Gold as Currency

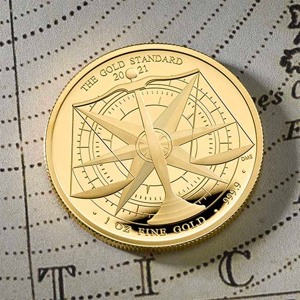

Source: Baldwin’s

Gold’s allure is ageless, quite literally.

Ancient Civilisations and Gold

From ancient Egyptians who considered it the flesh of gods to the Greeks who minted coins from it, gold’s intrinsic value was recognised early on. Its durability, rarity, and brilliance made it a preferred medium of trade and store of value.

The Gold Standard

Fast forward to more modern times, and many countries adopted the gold standard. This meant that the value of a currency was directly linked to a specific amount of gold.

This system, however, isn’t prevalent today, but it paved the way for the complex relationship between gold and currencies.

The Timeless Lure of Gold

Gold has always been considered a safe haven for investors. In times of economic uncertainty, it often becomes the preferred asset due to its perceived inherent value. Unlike paper currency, gold retains physical value—an anchor in the stormy seas of economic fluctuation.

Understanding the Basics

Gold and currency have an inverse relationship. When the value of a currency decreases due to factors like inflation, the value of gold typically goes up. Why? Because as paper money loses its value, investors look for tangible assets like gold to preserve their wealth.

The Basics of Gold Pricing

To understand why gold’s value changes in different currencies, one must first comprehend the fundamentals of gold pricing. Gold is primarily priced in U.S. dollars per ounce on the global market. When assessing its value in other currencies, the conversion rate directly affects the price of gold.

Exchange Rates and Gold Value

Exchange rates play a pivotal role in the valuation of gold in different currencies. If a currency weakens against the dollar, gold becomes more expensive in that currency, and vice versa. This inverse relationship is a fundamental principle in the pricing of gold internationally.

Factors Affecting Gold Prices

Economic Indicators and Gold Pricing

When there’s economic instability, gold shines brighter. Investors flock to the safety of gold when there’s uncertainty in the market.

- Inflation’s Role: Inflation can devalue a currency, and as it rises, so often does the price of gold in that currency. This is because gold is often viewed as an inflation hedge, retaining its value while the purchasing power of currency diminishes.

- Interest Rates Influence: Interest rates affect the opportunity cost of holding non-yielding assets like gold. When interest rates rise, gold holding becomes less attractive compared to interest-bearing assets, potentially decreasing its value in local currencies.

- Supply and Demand Dynamics: The basic economic principle of supply and demand also dictates gold prices. During times of high demand, such as economic instability or high consumer electronics production (which uses gold), the price in all currencies generally rises.

Geopolitical Tensions

- How Conflicts Impact Gold: Geopolitical unrest often leads to increased investment in gold, considered a safe asset. This can cause gold prices to surge across different currencies, especially those seen as less stable or more directly impacted by the conflicts.

- Sanctions and Gold Trade: Trade sanctions can isolate countries from the global gold market, creating disparities in gold prices as they may have to resort to alternate means of valuation and purchase that do not align with global standards.

- Central Banks’ Impact on Gold’s Value: Central banks hold significant gold reserves and their policies can greatly affect gold’s value.

Why Gold Prices Differ Across Currencies

We get that gold’s value can go up or down. But why different values in different currencies?

Exchange Rates and Their Influence

Imagine you’re exchanging your country’s currency for another. One day you get more for your money and the next day, less. This fluctuation is a daily reality for gold as well. Because gold is internationally priced in U.S. dollars, when the dollar strengthens against other currencies, you can buy more gold for less of those currencies.

Conversely, if the dollar weakens, gold becomes relatively more expensive when priced in those other currencies. This direct tie to the U.S. dollar means that changes in the dollar’s strength cause an immediate ripple effect in gold’s local prices around the world.

Economic Policies of Different Countries

Just like local laws and regulations that shape the business landscape, economic policies crafted by a nation’s central bank heavily influence the value of its currency – and, as a result, the price of gold in that currency.

Interest rates are a prime example. If a country raises its interest rates, its currency often strengthens as investors seek higher returns, making gold less attractive as it bears no interest. In countries where the interest rates are low, gold might maintain its luster as an investment since the opportunity cost of holding it is relatively low compared to other assets.

Local Demand and Supply

If a nation’s appetite for gold spikes—perhaps due to cultural factors like wedding seasons or economic drivers like market uncertainty—and if the supply can’t keep up, gold prices in that country’s currency will likely climb.

It’s akin to a local favourite restaurant that’s always packed; they might raise their prices knowing people will pay more for what’s in high/increased demand. This is true for gold: if there’s a rush for it locally and it’s scarce, the prices will undoubtedly rise in that local market.

Key Takeaways: The Golden Thread Binding Economies

Gold’s value, in essence, reflects our global economy’s pulse. Whether it’s the United States dollar or the Indian rupee, gold’s fluctuating value captures the essence of economic shifts, policies, and perceptions. The exchange rate impact on gold is undeniable, serving as a direct translator of a currency’s current standing on the global stage. The past gold value fluctuations provide a historical script, detailing the intricate relation between economy and gold—a relationship that has stood the test of time, crises, and countless policy changes.

Factors such as the factors affecting gold demand—ranging from technological innovations to cultural inclinations—continuously write new chapters in gold’s saga. Gold maintains its stature as a premier entity for gold as in an investment portfolio, an asset class that resonates with the investor’s desire for something tangible amid the ephemeral nature of fiat currencies. The vast holdings of central bank gold reserves serve as a testament to gold’s unwavering significance, acting as a bedrock of trust in a country’s financial stability.

Moreover, global crises and gold value share a bond that has historically seen the precious metal become a sanctuary during times of economic turbulence. Gold isn’t just a metal; it’s a story of our times, a narrative enmeshed with the fabric of global economics.