Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Why Do Gold Bars Have Lower Premiums Than Gold Coins?

When considering precious metals investing, one of the pivotal decisions investors face is whether to purchase gold bars or gold coins.

This decision not only influences the liquidity and growth potential of one’s portfolio but also affects the overall cost of investment due to the premiums associated with these assets.

This article will look at the reasons behind the lower premiums of gold bars compared to gold coins, offering insights that can guide both novice and seasoned investors in making informed choices.

The Basics of Gold Investment

Gold Bars

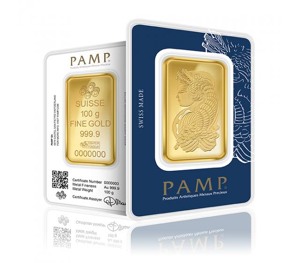

Gold bullion bars, often referred to as bullion, are quantified blocks of gold ranging in size from small 1 gram gold bars, to 1oz gold bars, to large 1kg London Good Delivery bars. Their value is primarily based on the gold content and the current market price of gold in the bullion market.

Gold Coins

Gold coins, on the other hand, are minted by governmental authorities and private entities, such as The Royal Mint, featuring intricate designs and often holding legal tender status. They come in various sizes, with 1 ounce being among the most popular.

Why Do Gold Bars Have Lower Premiums

1) Economies of Scale in Production

The production of gold bars benefits from economies of scale. Larger bars require less overall craftsmanship and packaging per ounce of gold, leading to lower manufacturing costs passed on to investors as lower premiums.

2) The Cost of Design and Artistry

Gold coins frequently feature elaborate designs, requiring detailed craftsmanship, such as products such as the British Britannia Gold Coin, and Gold Sovereigns. This artistry, along with the coin’s collectibility and potential historical value, contributes to higher premiums over the spot price of gold from bullion dealers.

3) Market Demand and Liquidity

Gold bars generally cater to a different segment of the investor population compared to gold coins. Bars are often favoured by institutional investors or those looking to invest significant amounts in gold, leading to a demand structure that supports lower and more competitive premiums. For example, jewellers often purchase large gold bars to melt down and repurpose into their own products, therefore do not want to pay a higher premium.

4) Storage and Security Costs

Due to their larger sizes and straightforward design, gold bars can be stored more efficiently than coins. This may lead to reduced storage and security costs for investors and dealers alike.

Comparing Premiums: Bars vs. Coins

Through various case studies, it becomes evident that premiums on gold bars can be significantly lower than those on gold coins, especially when purchasing larger bars. This disparity is influenced by the factors previously discussed, including production costs, design intricacies, and market demand.

Which you invest in often depends on personal preferences

Gold coins can offer historical and collectible value beyond the intrinsic gold content, appealing to investors interested in diversification. Coins and bars are both promising investment decisions, which bullion product you invest in may depend on the form of gold that appeals to you most.

Investor Considerations

Investors should consider their long-term investment goals. Those seeking to maximise the gold content of their investment at the lowest cost might prefer gold bars due to their lower premiums.

The premium of a gold bar decreases with size

The cost of making a single kilogram gold bar is less than that of ten individual 100-gram gold bars.

So, purchasing a kilogram gold bar as opposed to ten individual 100g gold bars will be less expensive for you. Despite being less expensive, this choice will reduce the flexibility of your portfolio. A kilogram gold bar cannot be split in half, thus you won’t be able to sell off a portion of your investment.

Furthermore, some dealers will be less likely to want to purchase a big gold bar than several 1oz gold bars. Therefore, smaller denominations may make your investment easier to buy and sell.

The choice between gold bars and coins may also depend on the investor’s horizon. Bars might be more suitable for long-term holdings in larger sizes, whereas coins can offer more flexibility for shorter-term investments. However, both products are considered a safe haven asset, so have lower risk potential.

Conclusion

Understanding why gold bars have lower premiums than gold coins is fundamental for any investor considering entering the gold market.

By considering factors such as economies of scale, design costs, market demand, and investment objectives, individuals can make more informed decisions tailored to their investment strategy and goals.

As we navigate through the complexities of gold investment, it becomes clear that each form of gold, be it bars or coins, serves different purposes and caters to diverse investor needs. Ultimately, the choice between gold bars and gold coins should align with one’s investment objectives, risk tolerance, and the desired balance between liquidity and long-term value.

FAQs

1) Why is the premium on silver bullion so high?

The premiums paid for silver bullion appear to be higher than those for gold, for reasons that include the complex dynamics of supply and demand, the wide range of industrial uses for silver, the different investment objectives of gold, and the difficulty associated with limited availability. Read more about silver bullion premiums here.

2) How is the premium from SPOT price calculated?

The amount a buyer pays for gold or silver above the spot price is known as the premium. To learn more about how premiums are calculated, read here.

3) Why do gold bullion coins have different premiums?

It’s essential to balance premium costs with the potential for future appreciation in value and personal investment goals. To learn more, read here.