Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

What Type of Gold Bullion Is Easiest to Sell and Why

Gold bullion is not only a tangible asset but also a popular investment choice due to its perceived stability and value retention. However, when it comes to selling gold bullion, not all forms are created equal.

Understanding the dynamics of the gold market and the factors influencing sellability can help investors make informed decisions. In this article, we’ll delve into the various types of gold bullion and determine which is the easiest to sell and why.

Popular Types of Gold Bullion

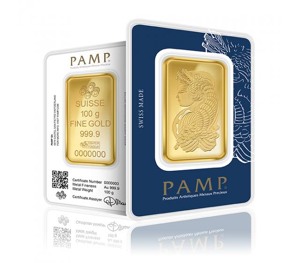

Gold bullion comes in different forms, including bars, coins

While each offers inherent value, their sell-ability can differ significantly.

Gold bars are typically available in various weights, making them popular among institutional investors. Gold coins, on the other hand, appeal to collectors and investors alike due to their aesthetic appeal and historical significance.

Factors Affecting Sell-Ability

Several factors influence how easy it is to sell gold bullion.

Firstly, the purity of the gold plays a crucial role, as higher purity bullion is generally more sought after. Additionally, the condition of the bullion, whether brand new or circulated, can impact its resale value.

Moreover, market conditions and investor sentiment can fluctuate, affecting the demand for certain types of gold bullion.

Ease of Authentication

Authentication is paramount in the gold market to ensure the integrity of the bullion being traded.

While reputable mints and brands provide assurance of authenticity, counterfeit bullion remains a concern

Certain forms of fine gold bullion, such as coins with intricate designs and security features, are easier to authenticate than others.

Recognition and Trust

The reputation of the mint or brand behind the gold bullion can greatly influence its sell-ability.

Established mints with a long-standing history of producing high-quality bullion in-still confidence in buyers and dealers alike. Recognisable brands are often preferred, as they are associated with reliability and authenticity.

Read more on the topic here: Our Official Partners

Market Demand and Pricing

The demand for gold bullion fluctuates based on various factors, including economic conditions, geopolitical events, and investor sentiment.

Bullion that is in high demand tends to be easier to sell and may command higher premiums. Additionally, pricing transparency is crucial, as buyers are more inclined to purchase bullion with fair and competitive prices.

Storage and Transportation

The ease of storing and transporting gold bullion can impact its sell-ability, especially for larger quantities. While gold bars are compact and stackable, they require secure storage facilities. Coins, on the other hand, are more portable and can be easily transported or stored in smaller safes.

Dealer Preferences

Gold dealers play a pivotal role in the buying and selling of bullion. Understanding dealer preferences can help investors choose the most liquid forms of gold bullion.

Dealers may have specific criteria regarding the types and brands of bullion they are willing to buy, which can influence sell-ability. Most dealers, including Tavex, have an online selling platform and an online marketplace which allows customers an easy way to sell back your gold to a reputable bullion dealer.

Tax Implications

Tax considerations are essential when selling gold bullion, as they can impact the net proceeds from the sale.

Different forms of gold bullion may be subject to varying tax treatments. For instance, consider British Gold Coins minted by The Royal Mint, which enjoy tax free advantages of being exempt from capital gains tax and VAT. Understanding the tax implications can help investors optimise their selling strategy and minimise tax liabilities.

Read more on the topic here: Capital Gains Tax (CGT) and Gold

Customer Preferences

Customer preferences play a significant role in determining the sell-ability of gold bullion.

While some investors prioritise purity and weight when buying gold bars or gold coins, others may place greater emphasis on collectibility and aesthetic appeal.

Catering to diverse customer preferences can broaden the market for pure gold bullion and enhance its sell-ability.

Investment Versus Collectible

Distinguishing between investment-grade and collectible gold bullion is essential for investors seeking liquidity.

While investment-grade bullion is primarily valued for its gold content and purity, collectible bullion may carry additional premiums due to rarity and historical significance. Understanding the distinction can help investors choose the most liquid forms of gold bullion for your investment portfolio.

Conclusion

In conclusion, the world of gold bullion investment offers a myriad of choices, each with its own set of advantages and considerations. While gold bullion, in general, is prized for its stability and value retention, not all forms are equally easy to sell.

Factors such as purity, recognition, market demand, and dealer preferences all play significant roles in determining the sell-ability of gold bullion. Gold bars, coins, and rounds each have their own appeal, catering to different types of investors and collectors.

Ultimately, investors should carefully weigh up these factors. Investors should consider their own investment goals and preferences when choosing which type of gold bullion to invest in. Whether it’s the liquidity of gold bars, the historical significance of coins, or the aesthetic appeal of rounds, finding the right balance between ease of sale and personal preference is key.

By understanding the dynamics of the gold market and the factors influencing sell-ability, investors can make informed decisions that maximise the potential for profit and minimise risk. In an ever-changing economic landscape, gold bullion remains a steadfast investment choice, offering stability and security for investors worldwide.