Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

What is 'Investment Grade' Gold Bullion?

Investment grade gold bullion refers to gold products that meet specific standards of purity, authenticity, and quality, making them suitable for investment purposes.

Unlike gold jewellery or decorative items, which may have lower purity levels and aesthetic features, investment grade gold bullion is primarily valued for its financial worth and is often purchased by investors seeking to diversify their portfolios or hedge against economic uncertainties.

This article will explore what gold can be defined as investment gold, what to consider when adding investment gold to your investment strategy, and some of our key takeaways.

What Makes Gold Bullion Investment Grade?

Gold bullion as a type of investment has been around for a long time, but what makes this physical asset ‘investment grade’?

Investment grade gold bullion is distinguished by several key factors that determine its suitability for investment:

1) Purity Standards

One of the primary criteria for investment grade gold bullion is its purity level. Gold bullion products typically have a purity measured in karats or fineness, with higher purity indicating a greater gold content.

Common purity levels for investment grade gold bullion range from 99.5% to 99.99%

2) Authenticity and Certification

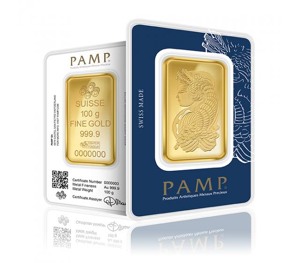

Investment grade gold bullion must be accompanied by proper certification to validate its authenticity and quality. This certification is often provided by recognised mints, such as The Royal Mint, or assay offices and includes detailed information about the bullion’s weight, purity, and origin.

Why Invest in Gold Bullion?

Investors are drawn to gold bullion for several reasons, including:

- Hedge against Inflation: Gold has historically served as a hedge against inflation, preserving purchasing power during periods of currency devaluation and stock market fluctuation.

- Portfolio Diversification: Gold bullion offers diversification benefits, helping to reduce overall portfolio risk by providing a counterbalance to traditional asset classes such as stocks and bonds which may have more volatile stock prices.

- Store of Value: Gold is widely regarded as a store of value, maintaining its worth over long periods and serving as a reliable asset in times of economic uncertainty. This is significant in 2024 with upcoming interest rate talks by The Federal Reserve, which poses some uncertainty for many.

Different Forms of Gold Bullion

Gold bullion is available in various forms, including bars, coins, and rounds

Each form has its own advantages and considerations, catering to different investor preferences and objectives. Additionally, the price of gold bullion with its premiums will vary depending on the size of gold you are purchasing. For example the larger the gold bar, the better value for money you will get in terms of premiums above SPOT.

To learn more, read more on the topic here: Why do gold bars have lower premiums than gold coins?

How to Identify Investment Grade Gold Bullion

Investment grade gold bullion can be identified through various markers, including:

- Assay Marks: Official stamps or marks indicating the bullion’s purity and weight.

- Hallmarks: Identification symbols indicating the manufacturer or mint responsible for producing the bullion.

- Recognised Mints: Gold bullion produced by reputable mints or refineries is more likely to meet investment grade standards.

Where to Buy Investment Grade Gold Bullion

Investors can purchase investment grade gold bullion from a variety of sources, including authorised dealers, online platforms, and auctions. It’s essential to conduct thorough research and choose reputable sellers to ensure the authenticity and quality of the bullion.

At Tavex, we have a wide selection of products ranging from gold bars, to gold coins, to silver bullion and even other products such as Tavex gloves! Here are some of our top selling products:

Storing Investment Grade Gold Bullion

Deciding where to store investment grade gold bullion is a crucial consideration for investors. While some prefer to store bullion at home for immediate access, others opt for secure facilities such as bank vaults or private storage facilities to minimise risks associated with theft or damage.

Market Liquidity and Resale Potential

Investment grade gold bullion typically enjoys high market liquidity, meaning it can be easily bought and sold on secondary markets.

Factors such as the bullion’s condition, rarity, and current market conditions influence its resale potential and value

If you are interested in buying or selling your investment, contact us on +44 (0)20 4541 4145 or email us at tavex@tavexbullion.co.uk to speak to one of our experts.

Tax Implications of Investing in Gold Bullion

Investors should also consider the tax implications of owning gold bullion, including capital gains tax on profits realised from the sale of bullion and reporting requirements for certain transactions.

Gold coins produced by The Royal Mint benefit from the status of being a legal tender meaning they gain exemption from Capital Gains tax.

Read more on the topic here: Capital Gains Tax (CGT) and Gold.

Long-Term Outlook for Gold Bullion

Historically, gold bullion has demonstrated resilience and stability as an investment asset, with its value often increasing over the long term.

While short-term fluctuations may occur, many investors view gold bullion as a reliable store of value and a hedge against economic uncertainty.

Read more on the topic here: Will gold hit another all time high in 2024?

Key Takeaways

The bottom line is that investment grade gold bullion offers investors a tangible asset and reliable means of diversifying their portfolios and safeguarding against economic uncertainties. Defined by stringent purity standards and accompanied by proper certification, these assets provide a secure store of value and serve as a hedge against inflation and market volatility.

The allure of gold bullion lies in its historical resilience and long-term appreciation, making it a compelling investment choice for those seeking stability and wealth preservation. Whether in the form of bars, coins, or rounds, gold bullion offers liquidity and potential for capital appreciation, further enhancing its appeal to investors.

While considerations such as storage, taxation, and market dynamics should not be overlooked, the intrinsic value and enduring appeal of gold bullion underscore its status as a cornerstone asset in a well-rounded investment strategy.

As economic landscapes evolve and financial markets fluctuate, investment grade gold bullion stands as a steadfast anchor, offering stability, security, and enduring value to investors worldwide.

For those looking to embark on their gold investment journey or expand their existing holdings, reputable dealers and trusted platforms provide access to a diverse range of investment grade gold bullion products, ensuring transparency, authenticity, and peace of mind.

In an ever-changing world, the timeless allure of gold endures, beckoning investors with the promise of wealth preservation and financial security for generations to come.