Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

What is Gold Bullion?

When it comes to precious metals and investments, gold has always held a special place in the hearts of investors and collectors alike. Gold bullion, in particular, is a term that frequently surfaces in discussions about gold, but what exactly is gold bullion?

This article will dive into the world of bullion, exploring its definition, forms, history, and why it remains an attractive option for those seeking to invest in tangible assets.

Gold Bullion – The Definition

Defining Gold Bullion

Gold bullion, simply put, refers to gold in its purest and most basic form. Unlike gold jewellery or numismatic coins, which often carry additional value due to craftsmanship or rarity, gold bullion’s worth is primarily derived from its intrinsic precious metal content.

It typically comes in the form of bars, coins, or ingots, and its purity is expressed in fineness, commonly measured in parts per thousand (e.g., 99.9% pure gold is often expressed as .999).

Characteristics of Gold Bullion

Gold bullion is characterised by several key features:

- High Purity: Gold bullion is renowned for its high levels of purity, making it an excellent store of value. This purity ensures that its worth remains closely tied to the prevailing market price of gold.

- Standardised Weight and Size: Bullion products are typically manufactured to meet specific weight and size standards, allowing for easy verification of their authenticity and value.

- Liquidity: Gold bullion is highly liquid, meaning it can be easily bought or sold in various markets worldwide.

- Diversification: It serves as a valuable tool for diversifying investment portfolios, offering a hedge against economic instability and currency devaluation.

Exploring the Different Forms of Gold Bullion

Bars

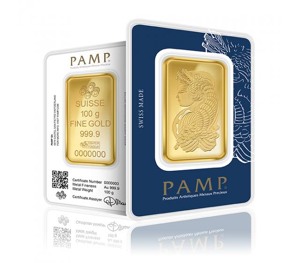

One of the most common forms of gold bullion is bars or ingots. These bars come in various sizes, ranging from small gram bars to much larger kilo bars. They are typically produced by accredited refineries and carry markings indicating their weight, purity, and origin. Gold bullion bars are favoured by institutional investors and central banks due to their high purity and ease of storage.

Coins

Gold bullion coins are another popular choice among investors. These coins are produced by government mints and are legal tender in the country of issue. Notable examples include the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand.

Rounds

Gold bullion rounds are similar to coins in appearance but do not carry a face value. They are typically privately minted and often favoured for their low premiums over the spot price of gold. Like coins, gold bullion rounds come in various designs and sizes, making them accessible to a wide range of investors.

The Historical Significance of Gold Bullion

A Store of Wealth Throughout History

Gold has been used as a form of currency and store of wealth for millennia. Civilisations from ancient Egypt to modern times have recognised the enduring value of gold.

Its scarcity, durability, and resistance to corrosion have made it a symbol of wealth and power

The limited supply of gold makes it retain is good store of value, which is significant in its changing value over time.

The Gold Standard

In the 19th and early 20th centuries, many countries operated on the gold standard, where the value of their currency was directly tied to a specific amount of gold bullion held in reserve.

While this system is no longer prevalent, gold remains an essential asset for central banks to bolster their currency reserves.

Why Invest in Gold Bullion Today?

Portfolio Diversification

In today’s uncertain economic climate, diversification is crucial for investors seeking to safeguard their assets.

Gold bullion offers an effective means of diversifying investment portfolios, as it often moves inversely to traditional assets like stocks and bonds

This inverse correlation can help mitigate risk during economic downturns, which is significant to consider when buying and selling of your assets, including bullion.

Protection Against Inflation

Gold investments has historically been a hedge against inflation. When the purchasing power of fiat currencies erodes due to inflationary pressures, the intrinsic value of gold remains intact, making it a reliable store of wealth.

Global Acceptance

Gold bullion is recognised and traded worldwide as an investment option, providing investors with a globally accepted and liquid asset. This ease of trading makes it a valuable addition to any investment strategy.

Key Takeaways

Gold bullion, in its various forms, is a tangible and time-tested asset that holds a unique place in the world of investments. The value of gold bullion, historical significance, and potential for portfolio diversification make it a compelling choice for buying gold bullion for both seasoned investors and those looking to safeguard their financial future.

Whether in the form of bars, coins, or rounds, gold bullion continues to shine as a reliable store of wealth in an ever-changing economic landscape.