Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

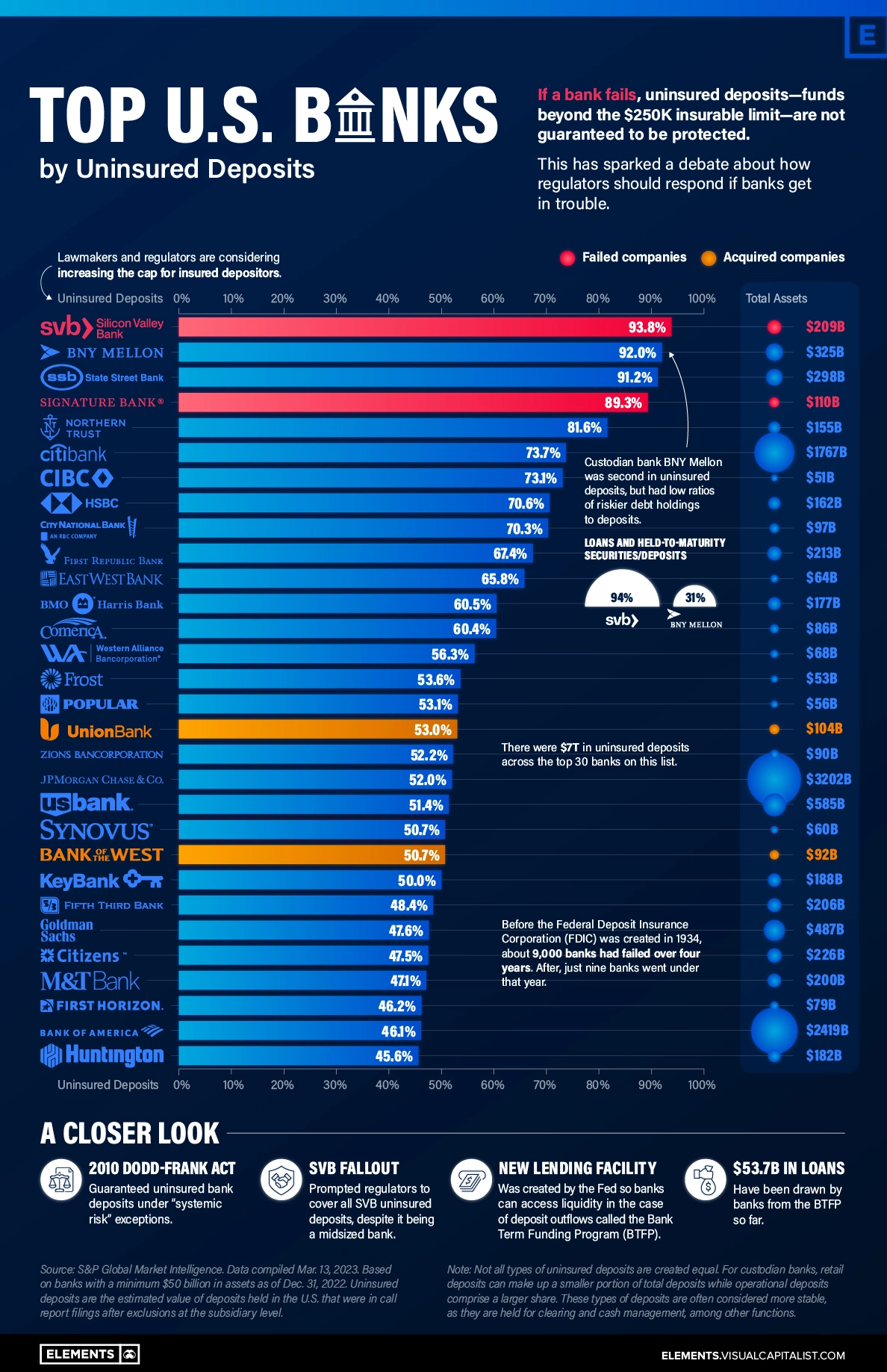

TOP Banks With the Most Uninsured Deposits

Dorothy Neufeld and Sabrina Lam have compiled a list of the 30 banks with the highest number of uninsured deposits on Visual Capital. At the top of the list are a number of banks critical to the financial system.

To date, the US has a total of $7 trillion in uninsured deposits.

This figure is three times the market value of Apple and equates to around 30% of US GDP. Deposits above $250 000 are uninsured – this is the limit insured by the FDIC. Prior to the 2008 global financial crisis, insured deposits were $100 000. Uninsured deposits account for 40 percent of all deposits.

In the wake of the collapse of Silicon Valley Bank (SVB), we take a look at the 30 banks with the highest share of uninsured deposits. The list is compiled using data from S&P Global.

Which banks have the most uninsured deposits?

The image above shows the list of banks with the highest number of uninsured deposits. Banks with at least $50 billion in assets at the end of 2022 are included.

Bank of New York (BNY) and State Street Bank have the highest number of uninsured deposits. These are also the two largest US depository banks. Custodians are critical to the infrastructure of the financial system – they hold, settle and account for funds and perform other functions as required by the custody agreement.

Both BNY Mellon and State Street are considered ‘systemically important’ banks.

How are these banks different from the SVB? Their loans and held-to-market securities are much smaller than their total deposits. Held-to-maturity securities are, for example, bonds held to maturity. These loans accounted for 94 per cent of SVB’s deposits, compared with 31 and 40 per cent for BNY Mellon and State Street.

Held-to-maturity securities carry much higher risks for banks. Many of these securities have lost value following the rapid rise in interest rates. The rise in interest rates therefore entails many risks for the banks holding these securities. The value of US long-term government bonds fell by around 30 percent in 2022. If a bank sells these assets ahead of maturity, they will have to absorb heavy losses.

Overall, there are 11 banks whose loans and held-to-maturity securities account for more than 90 percent of total deposits.

Extinguishing a fire

To avoid major consequences, regulators took extraordinary measures. All the deposits of SVB and Signature Bank were guaranteed just days after the collapse of the banks.

The Federal Reserve also set up an emergency lending facility for banks called the Bank Term Funding Program (BTFP). It provides funding to banks whose depositors have started to withdraw money from the bank. It also deals with the interest rate risk that banks face.

So far, the agency has borrowed $50 billion, with $11.9 billion in loans issued in the first week (the Federal Reserve updates these numbers weekly). This has caused the Federal Reserve’s balance sheet to grow again, despite the decision to start reducing it in 2022.

What does this mean for the financial system?

What does it mean for the US banking system, depositors and the financial system in general?

On the one hand, the Federal Reserve did not have a choice – banks needed to be bailed out. Charlie Munger, a long-time business partner of the world’s best-known investor Warren Buffett, said:

“In the current world, the government had no choice but to guarantee all deposits. Otherwise you would have seen the biggest bank run in our lifetime.”

The bigger problem is that it adds risk to the system. If market participants expect the Federal Reserve to always come to the rescue, then they will no longer be so cautious in their decision making. The period of excessively high interest rates made banks more sensitive to rate hikes. At the same time, it reduced the price paid for taking on risk.

Now the Federal Reserve says steps may be taken to protect uninsured deposits. How fast the volume of loans issued by BFTP will increase over the next few months is anyone’s guess.

The compilation of the 30 US banks with the highest amount of uninsured deposits reveals that these banks are critical to the financial system. With a total of $7 trillion in uninsured deposits, equivalent to 30% of the US GDP and 40% of all deposits, the risks associated with held-to-maturity securities and interest rates pose challenges for the banking system. Regulators have taken extraordinary measures, including setting up the Bank Term Funding Program, to ensure stability in the banking system. However, the guarantee of all deposits adds risk to the system, and the Federal Reserve is considering steps to protect uninsured deposits.