Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Silver Coins vs. Silver Bars: Considerations for Your Investment?

When it comes to investing in precious metals, silver has always held a special place in the hearts of investors. Its timeless allure, coupled with its historical significance, makes it a sought-after asset for both seasoned investors and newcomers to the world of wealth preservation. However, a common dilemma for silver investors is choosing between silver coins and silver bars. Each option has its unique advantages and considerations.

In this article, we will dive into the key differences and help you determine which is the better investment for your financial goals.

The Basics: Silver Coins vs Silver Bars

Silver Coins

Silver coins are perhaps the most recognisable form of silver investment. They have been minted by governments and private mints worldwide for centuries.

Some of the most popular silver coins include the Canadian Silver Maple Leaf, and Austrian Silver Philharmonic, to name a couple. At Tavex our silver coins mainly have a silver content of 1 troy ounce of fine silver. Here are some key points to consider when investing in silver coins:

1. Liquidity and Recognisability

- Silver coins are highly liquid and easily recognisable among the bullion market and beyond, making them a preferred choice for beginners.

- Their familiar designs and government-backed authenticity enhance their marketability. For example, the Silver Britannia Coin has the renowned figure of Britannia on it, rooting deeply in British history.

2. Premiums

- Silver coins typically come with higher premiums over the spot price compared to silver bars, making purchasing silver coins more attractive.

- These premiums cover the production, minting, and distribution costs.

Silver Bars

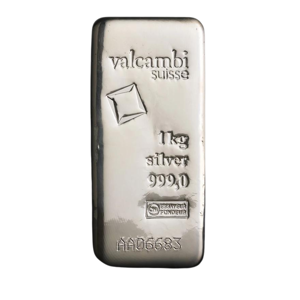

Silver bars, also known as silver ingots, are rectangular pieces of pure silver. They come in various sizes, ranging from small 1-ounce bars to larger 100-ounce bars. Here are some key considerations for investing in silver bars:

1. Cost-Effective

- Silver bullion bars often have lower premiums compared to silver coins, making them a cost-effective, and popular choice for investors looking to acquire more silver for their money.

2. Storage

- Due to their compact shape, silver bars are easy to stack and store efficiently, requiring less space compared to a similar weight of silver coins.

3. Purity

- Silver bars typically have a higher purity level (99.9% or more) compared to silver coins, which may contain small amounts of alloy to ensure durability.

Factors Influencing Your Decision

Investment Goals

Your investment goals play a pivotal role in deciding between silver coins and silver bars.

If you’re primarily interested in wealth preservation and ease of liquidation, silver coins may be the better choice due to their recognisability and market acceptance

On the other hand, if you’re focused on acquiring more silver for your investment budget, silver bars offer a cost-effective solution. Silver bullion bars also offer competitive prices in the realm of silver bullion products.

Premium Tolerance

Consider your willingness to pay premiums when choosing between silver coins and bars. Silver coins generally come with higher premiums, but they offer the added benefit of numismatic potential. If you’re willing to pay a bit more for collectible coins, silver coins may be a better fit.

If you prefer a lower premium and are solely interested in the silver’s intrinsic value, silver bars are a compelling option

Storage and Handling

Storage and handling logistics should also guide your decision. Silver coins, with their individual packaging and smaller sizes, may be more convenient for those with limited storage space. In contrast, silver bars are ideal for investors with ample storage capacity and a preference for easy stacking.

Key Takeaways

In the eternal debate of silver coins vs. silver bars, there is no one-size-fits-all answer. The choice ultimately depends on your unique investment objectives, budget, and storage capabilities. Silver coins offer recognisability and potential numismatic value, while silver bars provide a cost-effective way to acquire larger quantities of silver.

As with any investment, it’s essential to diversify your portfolio and consider a mix of both silver coins and bars to achieve a well-balanced strategy. Whichever path you choose, silver remains a tangible asset with a proven track record of preserving wealth, making it a valuable addition to any investment portfolio.