Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Gold vs. Land Investment: Which is Better for Your Future?

When it comes to securing your financial future, choosing the right investment is crucial. Among the countless options available, gold and land remain two of the most popular and trusted investment choices. But which one should you pick? Let’s break it down step by step to help you make an informed decision.

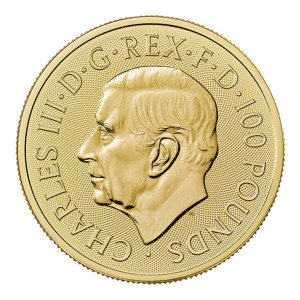

Understanding Gold Investment

Gold investment involves purchasing physical gold, investing in gold exchange-traded funds (ETFs), or even buying shares in gold mining companies. Each option offers unique advantages depending on your goals and risk tolerance.

Gold has always been a symbol of wealth and security. Historically, during times of economic uncertainty, people have turned to gold as a safe haven.

Benefits of Investing in Gold

- Liquidity: Gold can be easily bought or sold in markets worldwide.

- Inflation Hedge: Its value tends to rise when inflation increases.

- Global Demand: The demand for gold spans industries, including jewellery and technology.

Drawbacks of Gold Investment

- No Passive Income: Unlike land, gold doesn’t generate rental income.

- Market Volatility: Prices can fluctuate significantly in the short term.

Understanding Land Investment

Investing in land can involve buying residential plots, commercial spaces, or agricultural land. Each type comes with its own set of benefits and challenges.

Land values have historically appreciated, especially in areas experiencing urbanisation and economic growth

Benefits of Investing in Land

- Tangible Asset: Land is a physical and immovable asset.

- Passive Income: Renting or leasing land can generate a steady income stream.

- Long-Term Appreciation: Over time, land often increases in value.

Drawbacks of Land Investment

- High Initial Costs: Purchasing land requires a significant upfront investment.

- Market Risks: Land value depends on location, economic conditions, and regulations.

- Maintenance and Taxes: Landowners must account for ongoing expenses.

Comparing Gold and Land Investments

1) Liquidity

Gold is far more liquid than land. Selling gold is as simple as visiting a jeweller or using an online platform, while selling land can take months or even years.

2) Risk Factor

Both gold and land have market risks. Gold prices can fluctuate with global economic trends, whereas land value can be affected by local real estate markets.

3) Returns on Investment

While gold offers moderate returns, land has the potential for higher long-term returns, especially in prime locations.

4) Inflation Protection

Both assets serve as effective hedges against inflation. Gold protects purchasing power, while land value typically rises with inflation.

5) Diversification

Gold and land can both play essential roles in a diversified investment portfolio, balancing each other’s strengths and weaknesses.

Factors to Consider Before Choosing

Investment Goals

Are you looking for quick liquidity or long-term appreciation? Your answer will guide your choice.

Budget

Land requires a substantial upfront investment, while gold allows for smaller, incremental purchases.

Risk Tolerance

Gold is less volatile than land in terms of value depreciation, making it suitable for conservative investors.

Market Trends

Keep an eye on global economic conditions and local real estate developments to make informed decisions.

Pros and Cons at a Glance

Gold Investment Pros and Cons

Pros: Liquid, inflation hedge, universally valued.

Cons: No passive income, price volatility.

Land Investment Pros and Cons

Pros: Tangible asset, passive income potential, long-term growth.

Cons: High costs, market dependency, ongoing expenses.

Case Studies

Gold as a Safe Haven During Economic Downturns

During the 2008 financial crisis, gold prices soared as investors sought stability.

Land Appreciation in Growing Urban Areas

Urban areas with infrastructure development often see exponential land value increases, making it a lucrative investment.

Conclusion

Both gold and land offer unique benefits and challenges as an asset class. While both are considered a long term investment, gold is ideal for liquidity and hedging against economic uncertainty, while land is better for long-term growth and passive income.

The bottom line is your investment strategy choice ultimately depends on your financial goals, budget, and risk tolerance. It is also good to make sure you have portfolio diversification. Therefore maybe considering having some gold, some land, some stocks and bonds, and other assets.

FAQs

Which is more profitable: gold or land?

- The type of investment you choose depends on your goals. Land offers higher long-term returns, while gold is better for liquidity and stability.

Can I invest in both gold and land?

- Yes, combining both can diversify your portfolio and balance risk.

What are the tax implications for gold and land investments?

- Gold may incur capital gains tax, while land can involve property taxes and capital gains upon sale.

How do I start investing in gold?

- You can purchase physical gold, invest in ETFs, or buy shares in gold mining companies.

Is land a better option for retirement planning?

- Land can be excellent for retirement if it generates passive income or appreciates significantly.