Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Gold Surpasses Stocks to Become the Second Most Popular Long-term Investment Option in the US

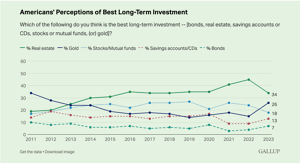

Investment preferences among Americans have been significantly reshaped, as revealed by a recent Gallup poll. While real estate continues to lead the pack as the most favoured long-term investment, gold has surged ahead, clinching the second position and surpassing traditionally popular asset classes such as stocks, bonds, and savings. The gradual rise in gold’s popularity underlines an interesting shift in investor sentiment, shaped by various macroeconomic factors and the challenging global landscape.

Gallup conducted a survey of Americans in the spring to find out which asset class is considered the best long-term investment. Gold came in second after real estate, outperforming stocks, bonds and savings.

While in 2022, 15 percent of Americans thought gold was the best long-term investment, this year that percentage has risen to 26 percent. Gold overtook stocks in popularity.

Real estate has topped the poll since 2013. In the last survey, as many as 35 percent of respondents considered it the best long-term investment. Admittedly, last year the figure was 45 per cent, so there has been a sharp decline.

Equities came third with 18 percent, followed by deposits (13 percent) and bonds (7 percent). If cryptocurrencies would be included, they received 4 percent of the vote.

Which asset class do you think is the best long-term investment?

Real estate in green, gold in dark blue, stocks in light blue, deposits in red and bonds in navy blue. Percentage of respondents. Source: Gallup.

Louise Street, an analyst at the World Gold Council, said that while higher interest rates have made real estate less attractive, the same cannot be said for gold.

“In one year, the number of people who consider gold the best long-term investment doubled. This is despite the fact that interest rates rose to a 16-year high in March,” Street said.

Gallup’s poll also aligns with gold demand data. Physical demand for gold rose to its highest level in 11 years last year, helped mainly by central bank purchases and investment demand.

Physical demand for gold rose to its highest level in 11 years last year, helped mainly by central bank purchases and investment demand.

Demand for gold bullion and coins increased by 2 percent in 2022, with the previous year also showing very strong demand. A total of 1,217 tonnes of investment gold were purchased last year. For two quarters in a row demand was around 340 tonnes, the last time this happened in 2013.

Demand from investors in the US and Europe has been particularly strong, with a total of 427 tonnes of investment gold bought last year. This exceeded the 2011 record of 416 tonnes.

The Street speculated that while institutional investors have been selling gold due to higher interest rates, inflationary pressures hitting US consumers may be a key driver of demand as people seek protection from inflation:

A Gallup poll shows that the popularity of savings as a long-term investment rose minimally – despite savings rates approaching 5 percent. But compared to inflation, this interest rate remains poor, and those who expect long-term inflation see gold as a more attractive investment. Our research shows that gold investors are well aware of gold’s potential as a hedge against inflation.

The World Gold Council survey shows that Americans “understand gold’s role as a long-term store of value and are conscious of its safety.” It also found that two-thirds of investors agree that “gold is good insurance in times of political and economic uncertainty” and that its value is increasing over time.

Comments by Tavex:

Gold has clearly gained a lot of popularity among investors over the past year. On the one hand, there are a number of reasons for this, such as geopolitical tensions (notably the war in Ukraine), high inflation and uncertainty about the global economy following the coronet crisis. On the other hand, there is also a link with movements in the prices of various assets. Gold prices have remained high in recent years, reflecting the general psychology of investors where assets that have performed well in the recent past are better valued. We can see that in 2011, gold was first in the poll with 34%, the same year that the price in dollars peaked, a peak that took almost 9 years to reach again. However, the current trend is likely to continue as the fundamental picture is strongly in favour of gold.

As evidenced by the latest Gallup poll and backed by the World Gold Council’s data, the perception of gold as a long-term investment is undeniably on an upward trajectory. Despite the interest rate hikes and growing appeal of savings rates nearing 5 percent, gold continues to hold its ground as an effective inflation hedge. The increasing geopolitical tensions, high inflation rates, and post-pandemic economic uncertainty have all played pivotal roles in reshaping the investment landscape. As gold continues to offer a sense of security amid the flux, it is expected that its popularity among investors will continue to grow, reinforcing its status as a solid, long-term store of value.