Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Gold Mining Stocks vs. Physical Gold as an Investment

For the past three years, shares of gold-mining companies have underperformed relative to physical gold bullion by one of the biggest margins in decades. Gold recently surpassed $2,220 per ounce to reach a new all-time high.

Investing in precious metals has always been an attractive option for investors looking to diversify their portfolios and hedge against economic uncertainties. Among the various options available, gold stands out as a timeless asset known for its stability and intrinsic value. However, when it comes to investing in gold, individuals often face a dilemma: whether to opt for physical gold or invest in gold mining stocks.

In this article, we’ll explore the pros and cons of both options to help investors make informed decisions.

Introduction to Gold Investments

Diversification is a fundamental principle of investment strategy aimed at spreading risk across different asset classes. Gold, with its low correlation to traditional assets like stocks and bonds which fluctuates on the stock market in the short term, serves as an effective diversification tool in investment portfolios.

Gold has been regarded as a store of value for centuries, offering protection against inflation and currency devaluation. Investors often turn to gold during times of economic uncertainty as a safe haven asset.

Understanding Physical Gold

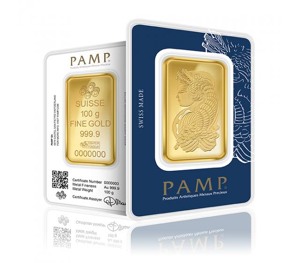

Buying physical gold, in the form of bullion or coins, provides investors with tangible assets that can be held directly

One of the key advantages of physical gold is its intrinsic value, which is not dependent on the performance of any particular company, market price, share price unlike investments such as exchange traded funds (ETFs).

However, storing and insuring physical gold can incur additional costs. Moreover, the liquidity of physical gold can vary depending on market conditions and geographical location.

The price of physical gold is influenced by various factors, including supply and demand dynamics, geopolitical tensions, central bank policies, and macroeconomic indicators like inflation rates and currency movements.

Exploring Gold Mining Stocks

Gold mining stocks represent ownership in companies involved in the exploration, extraction, and production of gold

Investing in gold mining stocks offers exposure to the gold industry’s potential upside while diversifying away from the risks associated with individual companies.

The performance of gold mining stocks is influenced by factors such as gold prices, production costs, reserve estimates, geopolitical stability, and operational efficiency of mining companies.

Additionally, a key factor for people investing in gold mining stocks is the ethos of the organisation they are investing in. More and more nowadays companies are under scrutiny from the public about their environmental social governance (ESG) which can have a huge influence on the performance of ones investment.

A Comparison: Physical Gold vs Gold Mining Stocks

1) Risk and Return Analysis

Gold mining stocks tend to exhibit higher volatility compared to physical gold due to factors like operational risks, exploration success, and commodity price fluctuations. However, this volatility can also translate into higher potential returns for investors.

Historical data suggests that gold mining stocks have outperformed physical gold during bull markets but underperformed during bear markets

The performance of gold mining stocks is closely tied to the overall health of the economy and investor sentiment towards the mining sector.

2) Market Trends and Economic Factors

Physical gold prices are influenced by macroeconomic trends such as interest rates, inflation, currency movements, and geopolitical events. Investors often turn to physical gold as a hedge against inflation and currency devaluation.

Gold mining stocks are influenced not only by the price of gold but also by company-specific factors such as production costs, reserve quality, and management decisions. Economic downturns can negatively impact the profitability of mining companies, leading to declines in stock prices.

3) Liquidity and Accessibility

Investing in physical gold requires purchasing bullion or coins from dealers or banks. While physical gold offers the advantage of tangible ownership, selling it may involve additional costs and logistical challenges.

Gold mining stocks are traded on stock exchanges, providing investors with liquidity and ease of trading. Unlike physical gold, which may require physical delivery or storage, gold mining stocks can be bought and sold with the click of a button through brokerage accounts.

4) Tax Considerations

In many jurisdictions, physical gold investments are subject to capital gains tax upon sale. However, tax treatment may vary depending on factors such as the form of gold (bullion or coins) and the holding period. Additionally, UK bullion coins produced by The Royal Mint are exempt from Capital Gains Tax (CGT), making them the perfect choice for someone looking for these tax exemptions.

Profits from investing in gold mining stocks are typically treated as capital gains and taxed at the applicable rates

Investors should consult with tax advisors to understand the tax implications of investing in gold mining stocks in their specific jurisdiction.

5) Investor Profiles and Preferences

The choice between physical gold and gold mining stocks depends on factors such as investment objectives, risk tolerance, and time horizon. Conservative investors may prefer the stability of physical gold, while more aggressive investors may seek higher returns from gold mining stocks.

Investment decisions regarding gold investments are influenced by various factors, including market conditions, economic outlook, geopolitical risks, and individual preferences. It’s essential for investors to conduct thorough research and assess their own risk-return preferences before making investment decisions.

Mitigating Risks and Maximising Returns

Strategies for Risk Management

Diversification is key to mitigating risks associated with gold investments. Investors can spread their exposure across different asset classes, including equities, bonds, real estate, and alternative investments, to reduce portfolio volatility.

Tips for Maximising Returns in Gold Investments

Timing the market, conducting thorough research, and staying informed about macroeconomic trends can help investors maximise returns in gold investments. Dollar-cost averaging, rebalancing portfolios periodically, and avoiding emotional decision-making are also essential strategies for long-term success.

Conclusion

Both physical gold and gold mining stocks offer unique advantages and drawbacks as investment options. While physical gold provides tangible assets with intrinsic value and serves as a hedge against economic uncertainties, gold mining stocks offer exposure to the potential upside of the gold industry and can generate higher returns in bull markets.

Ultimately, the choice between physical gold and gold mining stocks depends on individual investor preferences, risk tolerance, and investment objectives.

FAQs

1) What factors affect the price of physical gold bullion?

The gold price is affected by a variety of factors. Some of the main factors which play a role include changes in interest rates, inflation, industrial innovations, stock indices, central bank decisions and crises. To learn more about this, read here.

2) What is the future of gold mining?

Gold mining is rapidly evolving due to technological advancements and environmental concerns. Modern techniques are transforming how gold is discovered and extracted, emphasising efficiency, reduced environmental impact, and mineral resources. To learn more about this read here.