Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Gold Has Replaced Bonds as the Main Safe-Haven Asset

Over the past fifty years, US Treasuries have significantly outperformed gold as a buy-and-hold investment. However, the status of bonds as the primary “safe harbour” asset is now under threat, with the bond market facing unprecedented challenges, according to Bloomberg.

Traditionally, investors have considered US Treasuries the safest asset, providing stable income backed by the world’s most powerful economy – the United States. This assurance made US bonds more attractive than gold for many investors, including both individual savers and sovereign entities.

Unlike bonds, gold does not generate cash flow or passive income through interest

However, gold remains a desirable investment due to its limited supply and its ability to protect against inflation.

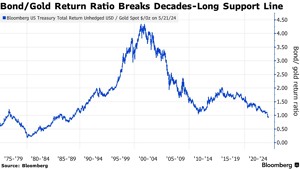

The traditional paradigm, along with how investors perceive bonds and gold, is shifting in favoUr of gold. The Bloomberg Treasury Total Return Index, which tracks bond yields, has declined in three of the past four years, including this year, amounting to an 11 percent drop since 2020. In contrast, gold reached a new record high this week, already showing a 15 percent increase for the year.

Bloomberg Bond Index to Gold Ratio: A ratio above 1 indicates that US Treasuries have outperformed gold since 1973. Conversely, a ratio below 1 signifies that gold has outperformed bonds over the same period. Source: Bloomberg.

Kristina Hooper, Chief Global Markets Strategist at Invesco, noted that the widening gap between gold and bonds reflects investor concerns over surging government debt and a growing preference for physical assets.

“Gold has become the main safe haven asset instead of bonds,” said Hooper. “The bigger issue is the concern about the excessive debt burden. It is feared that the fiscal situation of the United States is unsustainable.”

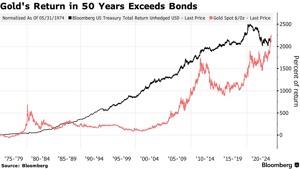

The decline in bond prices and the rise in gold prices indicate that gold is now outperforming bonds in the long term. A dollar invested in gold 51 years ago is now worth $23.14, which is $1.72 more than the value tracked by the Bloomberg Treasury Index, which monitors bond yields (excluding gold storage costs).

Gold and Bloomberg US Treasury Index Returns since 1973 (in percent). Source: Bloomberg

The recent decline in bond prices is straightforward to understand. It is primarily driven by the Federal Reserve’s aggressive monetary policy tightening, which began in 2022. This policy shift has pushed yields up from record lows, causing bond prices to plummet.

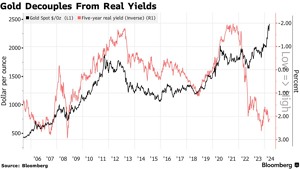

In contrast, the rise in gold prices is more perplexing. Theoretically, increasing “real” interest rates – those adjusted for inflation – should diminish gold’s appeal to investors, as gold does not generate interest or other cash flow. Despite this, gold prices have continued to climb higher and higher.

Gold price (in black) and real five-year bond yield (in percent, inverted). Source: Bloomberg.

Analysts note that one of the primary drivers behind the rapid increase in gold prices is the substantial gold purchases by central banks. For instance, China has been increasing its gold reserves for 18 consecutive months while simultaneously selling US Treasuries.

Additionally, there is growing concern over the escalating US debt burden and budget deficit. The US national debt has surged since the pandemic, nearly doubling over the past decade to reach almost $35 trillion.

Of course, bond yields have fluctuated widely over the past few decades compared to gold

While bonds have underperformed gold at times, they have also outperformed gold in the long term. When gold outperforms bonds, it often comes with higher volatility. For instance, during the 1970s, gold prices soared rapidly as investors sought protection against inflation.

Bonds caught up with gold after Federal Reserve Chairman Paul Volcker began aggressively raising interest rates to curb inflation. This marked the beginning of a 40-year bull run for government bonds. The yield on the US 10 – year bond fell from nearly 16 percent in 1981 to 0.3 percent in 2020.

This significant drop in yields led to a rise in bond prices, benefiting investors throughout this period. However, low bond yields also set the stage for future price declines. In 2022 alone, bond prices dropped by 12 percent as the Federal Reserve raised interest rates to combat inflation.

Julian Bridgden, co-founder of the investment firm Macro Intelligence 2 Partners, stated that the underperformance of bonds relative to gold is not a temporary phenomenon. An aging population and declining savings result in insufficient demand to match the ever-growing supply of bonds.

Key Takeaways

The financial landscape is witnessing a significant shift, with gold emerging as the preferred safe-haven asset over bonds issued by the US Treasuries. Historically, bonds have been viewed as the safest investment due to their stable income and backing by the US economy.

However, recent trends indicate a paradigm shift, driven by factors such as aggressive monetary policy, rising government debt, and changing investor preferences. As central banks increase their gold reserves and concerns about the US fiscal situation grow, gold’s appeal continues to strengthen in the short term and long term.

Despite its lack of cash flow, gold’s limited supply and inflation protection make it an increasingly attractive option for investors seeking stability in an uncertain economic environment.