Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Digital Gold vs. Physical Gold: The Difference

The significant fluctuations in the price of gold, with it reaching a high of $2128 on 4th March 2024, highlight the importance of formulating predictions to ensure security in your investment.

To see the live gold price take a look here.

Given this, investors often see digital gold as a more sensible alternative to buying physical gold as an investments. How well the Digital Gold project can adjust to these developments going forward will determine how sustainable it is. The use of blockchain technology, which supports Digital Gold’s sustainability, has benefits for security and transparency that encourage investor confidence. But physical gold provides more security in being able to physically hold and own your gold.

This article will explore these two forms of gold investment in depth, highlighting their differences, benefits, and potential drawbacks to guide you in making informed decisions that align with your financial goals.

What is Physical Gold?

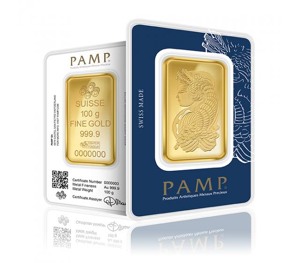

Physical gold, as an asset class, has been a cornerstone of wealth for millennia, cherished for its beauty and scarcity. Physical gold comes in various forms, including coins, and bars each with its unique appeal to investors.

According to research, it is predicted that there will be a 2-3% increase in gold prices for every 1% increase in the country’s inflation rate. With the rate of UK inflation and the upcoming March meeting to discuss the potential rise in interest rates, this is could be a good time for gold investors to start or continue investing in physical gold.

Read more about interest rates and their influence here: What is The Federal Reserve?

Benefits of Physical Gold

- Tangible Security: The physical nature of gold offers a concrete sense of security, allowing you to hold your investment in your hands.

- Historic Value Preservation: Gold has a proven track record of maintaining its value, particularly as a hedge against inflation and currency devaluation.

Drawbacks of Physical Gold

- Storage Challenges: Safekeeping physical gold not only requires secure storage solutions such as safes or safety deposit boxes but also incurs ongoing costs for insurance against theft or loss.

Read more on the topic here: How to Store Your Gold: A Comprehensive Guide

- Liquidity Concerns: While gold is universally valued, converting large amounts of physical gold into cash can be time-consuming and may require authentication or appraisal processes.

More on the topic here: Investing in Gold: Understanding the Benefits and Risks

What is Digital Gold?

Digital gold represents a modern twist on gold investment, allowing investors to own gold in a virtual format. Many investors need stability, and digital gold provides it in the face of the volatile gold market. This innovative approach means that for every unit of digital gold you purchase, an equivalent amount of physical gold is securely stored in vaults by the provider.

Younger investors are increasingly drawn to digital gold

Prior to Covid, 11% of The Royal Mint’s clientele was categorised as millennials. Currently, the percentage is over 29%. Furthermore, younger investors are beginning with smaller deposits before progressing to larger ones with digital gold.

Benefits of Digital Gold

- Ease of Transactions: Digital gold can be bought, sold, and managed online without the physical handling of gold, offering unparalleled convenience. Buying and selling digital gold often has quicker transaction times than physical gold.

- Fractional Ownership: It allows for investment in gold in any amount, making it accessible and cost effective to a broader range of investors, including those with limited capital.

- Security and Accessibility: By ensuring transaction security and transparency through the use of blockchain technology, many issues with traditional gold investing are resolved. Because it can be used with ERC-20 wallets, Digital Gold is more accessible and gives investors more options for storage platforms. An additional level of security for investors is provided by Digital Gold LTD’s implementation of rules and compliance requirements.

Drawbacks of Digital Gold

Digital gold investments could be considered more risky as you do not own a physical item

- Dependence on Digital Infrastructure: Investing in digital gold requires faith in the digital platform and its security measures, exposing investors to potential cybersecurity risks.

- Intangible Asset: While owning digital gold means you have rights to a physical asset, the lack of physical possession may be less satisfying for some investors.

Key Differences

- Accessibility: Digital gold is readily accessible online, breaking down geographical and logistical barriers associated with purchasing physical gold.

- Security: Physical gold’s security is as strong as your storage solution, whereas digital gold’s security hinges on cybersecurity measures and the trustworthiness of the platform.

- Liquidity: Digital gold offers greater liquidity, facilitating easier and faster transactions without the need for physical exchange.

- Investment Costs: Physical gold carries manufacturing, distribution, and retail markups, while digital gold may offer a more cost-efficient route with potentially lower transaction fees.

Which Should You Choose?

According to Andrew Dickey, the director of Precious Metals Investment at the Royal Mint, the demand for gold and precious metals has increased by 200% as younger investors choose the yellow metal over other assets. The decision between digital and physical gold boils down to personal preferences and investment strategies. Consider the following:

- Investment Goals: Are you looking for a tangible asset to pass down through generations, or are you seeking flexible investment options?

- Risk Tolerance: Evaluate your comfort level with digital platforms and cybersecurity risks compared to the physical risks associated with storing and securing gold.

- Portfolio Diversity: Both forms of gold can play a role in a diversified investment portfolio, offering different advantages and risk profiles.

More on similar topics: Bitcoin vs Gold: The Driving Forces Behind Their Prices

Final Thoughts

According to the World Gold Council, last year demand for physical gold hit 4,741 tonnes, the highest level since 2011. Navigating the choice between digital and physical gold involves weighing various factors, including accessibility, security, liquidity, and personal investment philosophy.

By understanding the nuanced differences and inherent benefits and drawbacks of each, investors can make choices that align with their long-term financial objectives and risk tolerance.

Both physical and digital gold may be wise investments if you’re trying to increase your wealth and stave off inflation. A lot of gold owners decide to split their holdings between physical and digital gold. It is advised that 10–20% of a sound investment portfolio be made up of gold to safeguard investors from risks associated with inflation, currency fluctuations, and market volatility.