Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Are 1 g Gold Bars Worth Buying?

In the world of investing, gold has always been considered a safe haven asset, prized for its intrinsic value and ability to preserve wealth over time.

While larger gold bars are often the go-to choice for some investors, the allure of 1g gold bars is undeniable, especially for those looking to dip their toes into the world of precious metals.

But are these small pieces of gold truly worth buying? Let’s delve into the intricacies of 1g gold bars to find out.

Advantages of Investing in 1g Gold Bars

Affordability

One of the most significant advantages of 1 g gold bars is their affordability.

Unlike larger gold bullion bars, which can require a substantial investment, 1g bars offer a more accessible entry point into gold ownership.

This makes them particularly appealing to individuals with limited capital or those who wish to diversify their investment portfolio without breaking the bank.

Flexibility

Another benefit of 1g gold bars is their flexibility. Their small size makes them easy to store and transport, allowing investors to conveniently hold onto their wealth without the need for large, cumbersome storage solutions.

Additionally, the ability to purchase 1g bars in small increments enables investors to gradually build their gold holdings over time, adapting to their financial circumstances and investment goals.

The smaller size of 1 gram bars can enhance their liquidity

In times of economic uncertainty, it may be easier to sell 1g gold bars back to reputable sellers. This liquidity factor when buying and selling, can be appealing to investors who may want quick access to their funds.

Accessibility

1g gold bars are widely available from a variety of sources, including reputable dealers and online platforms.

This accessibility ensures that investors have ample options when it comes to purchasing these miniature marvels, with the added assurance of obtaining genuine, high-quality gold products from trusted sources.

Factors to Consider Before Buying 1g Gold Bars

Purity and Authenticity

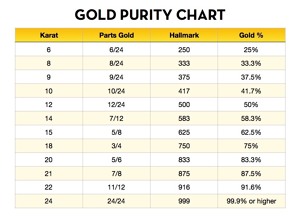

When purchasing 1g gold bars, it’s crucial to verify the purity and authenticity of the product.

Look for bars that are stamped with the weight and purity markings, indicating that they meet industry standards

Additionally, consider buying from reputable dealers or renowned mints to minimise the risk of purchasing counterfeit or substandard gold bars.

Premiums and Fees

While 1g gold bars may offer affordability in terms of initial purchase price of gold, it’s essential to factor in any premiums or fees associated with buying and storing these bars in an investment decision.

Some dealers may charge higher premiums for smaller bars, which can eat into your potential profits when it comes time to sell. At Tavex, the gold bar with the lowest premium is our 1 kg gold bar. Be sure to carefully compare prices and consider all associated costs before making your purchase.

Additionally, unique 1 gram bars with a limited mintage often have even higher premiums. These bars, as a type of investment, may be more appealing to investors who also value collectible factor.

Resale Value

Before investing in 1g gold bars, consider the resale value of these smaller denominations. While larger bars may command higher premiums due to their size and purity, 1g bars can still hold significant value, especially during times of economic uncertainty or market volatility.

However, be prepared for potential fluctuations in resale value and consider holding onto your investment for the long term to maximise returns.

Comparison with Other Gold Investments

1g Bars vs. Larger Bars

When deciding between 1g gold bars and larger denominations, it’s essential to weigh the pros and cons of each option. While larger bars may offer lower premiums and higher purity levels, 1g bars provide greater flexibility and accessibility, making them an attractive choice for novice investors or those with limited resources.

1g Bars vs. Gold Coins

Similarly, 1g gold bars can be compared to gold coins in terms of investment value. While coins may offer aesthetic appeal and historical significance, 1g bars provide a more straightforward and cost-effective means of investing in gold. Ultimately, the choice between bars and coins depends on individual preferences and investment objectives.

Read more on the topic here: Gold Bars vs Gold Coins

Risks and Challenges

Storage Concerns

One of the primary challenges associated with investing in 1g gold bars is storage.

While their small size makes them easy to store in a home safe or secure location, investors must take precautions to protect their investment from theft, damage, or loss.

Consider investing in a secure storage solution or utilising the services of a reputable custodian to safeguard your gold holdings.

Market Fluctuations

Like any investment, 1g gold bars are subject to market fluctuations and price volatility so it is important to assess the degree of risk.

While gold has historically proven to be a stable and reliable asset with little to no correlation to the stock market, investors should still be prepared for potential price swings and fluctuations in the value of their investment. This could be due to geopolitical events, interest rate fluctuating, and a myriad of other factors.

Diversifying your investment portfolio and holding onto your gold bars for the long term can help mitigate the impact of market volatility.

Market Trends and Demand

Current Demand for 1g Gold Bars

Despite their small size, 1g gold bars continue to attract significant demand from investors around the world. Their affordability, accessibility, and intrinsic value make them an appealing choice for both seasoned investors and newcomers to the market. As a result, demand for 1g gold bars remains robust, with steady sales reported by dealers and mints alike.

Future Outlook

Looking ahead, the future outlook for 1g gold bars appears promising. As economic uncertainty and geopolitical tensions persist, investors are increasingly turning to gold as a safe haven asset and hedge against inflation. This sustained demand, coupled with the convenience and accessibility of 1g bars, bodes well for their continued popularity and relevance in the investment landscape.

Tips for Buying 1g Gold Bars

In addition to reputable dealers, consider purchasing 1g gold bars directly from trusted mints or refineries. Mints such as The Royal Mint, PAMP Suisse, Valcambi, and Perth Mint are renowned for their craftsmanship and quality, offering investors peace of mind and assurance of authenticity.

While bars from these mints may command slightly higher premiums, the added confidence and security they provide are well worth the investment and potential higher returns.

Key Takeaways

In conclusion, 1g gold bars offer a compelling investment option and investment opportunity for individuals looking to safeguard their wealth and diversify their portfolios.

With their affordability, flexibility, and accessibility, these miniature marvels provide an accessible entry point into the world of gold ownership. This makes them an attractive option for both seasoned investors and newcomers alike in their investment strategy.

The bottom line is that while there are risks and challenges associated with investing in 1g gold bars, the potential rewards, rates of return, and benefits far outweigh the drawbacks, making them a worthy addition to any investment portfolio.