Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Alternative Investments and Alternative Investment Funds

Some of the most popular ways to invest in the world are stocks and bonds on the stock exchange. But in the last few years, so-called “alternative investments” have become increasingly popular through alternative investment funds.

What are these funds and what do they invest in? We will discuss this in this article.

What is an Alternative Investment?

An alternative investment is a financial asset that is not a stock, bond, or cash .

These types of investments are typically illiquid or illiquid – meaning they cannot be easily sold or converted into cash. They are often unregulated or poorly regulated by the U.S. Securities and Exchange Commission (SEC) or other global regulators. Alternative investments are sometimes called alternative assets.

Alternative investments were previously primarily for high net worth investors and institutional investors, but are becoming increasingly accessible and present in the market.

Retail, that is, individual investors, are increasingly given the opportunity to include these types of assets in their portfolios to try to reduce overall risk and maximise value in the long term.

Examples of Alternative Investments

Alternative investment funds have a wide range of assets, some of which are:

- Private equity – this is equity that is not listed on a public exchange. Private equity firms raise funds from institutional and non-institutional investors and use that money to buy businesses with the aim of later selling them and making a profit.

- Private Debt – Often alternative investment funds offer loans to other companies that may not be in a position to obtain financing from a bank or through a bond issue. Often these private funds offer better terms for these companies than traditional sources of financing.

- Real estate – investing in real estate or real estate-based securities. Alternative funds buy large amounts of property, with the goal of not only increasing property prices but also generating income from managing the properties themselves.

- Agricultural land – a combination of real estate and commodity investments, agricultural land is becoming an increasingly popular target for large investors. In addition to the increase in land prices, income is generated from the sale of produce.

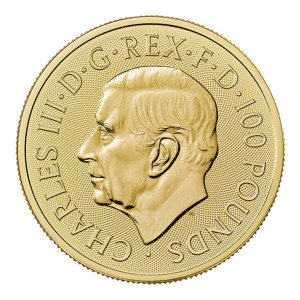

- Commodities and Raw Materials – investing in high-value commodities and raw materials, such as gold, silver, oil, or even agricultural products.

- Artwork and luxury goods – high-value artworks are another example of alternative investments. In addition, watches from special collections, rare car models or trophies from world and historically significant tournaments. All of these can be potential alternative investments.

- Cryptocurrencies – this is probably the most well-known alternative investment after real estate. In their form, they most closely resemble traditional investments, as they are traded on open markets. However, the high risk and lack of regulation place cryptocurrencies in the category of alternative investments.

There are other alternative investments, but this list is an example of some of the most popular. Of course, not all alternative investment funds invest in all of the listed options. Often they choose a few or even specialise in just one type of asset.

Difference Between Traditional Investments and Alternative Investments

Here we will refer to a comparison from Harvard:

- Traditional investments are investments that can be bought, sold, and traded on the public market. Stocks, bonds, and cash or cash equivalents are considered traditional investments. Because traditional investments are publicly traded, they can be converted into cash relatively easily and are considered highly liquid.”

- Alternative investments, on the other hand, are not publicly available for trading. This makes them less liquid than traditional investments and makes them more difficult to quickly convert into cash. They can be extremely complex and are usually not strictly regulated.

Due to the lack of strict regulation, there is often less transparency regarding these types of investments , making it extremely important for investors to conduct detailed analysis when evaluating an investment.

Alternative investments are considered riskier than traditional investments, but offer higher potential for returns

Due to their low liquidity, alternative investments typically have longer investment time horizons compared to traditional investments.

Alternative investments are undoubtedly more complex than traditional ones and carry with them the aforementioned risks and limitations. For this reason, it is extremely important for individual investors to be well informed and to conduct a detailed analysis before investing. New investors in particular should pay attention to whether this is the right investment for them.

Alternative Investment Gunds

Now that we have defined what alternative investment is, we can explain what alternative investment funds (AIFs) are.

The definition is very simple and similar to that of standard investment funds:

An Alternative Investment Fund (AIF) is a type of collective investment where funds are collected from multiple investors for the purpose of investing them in accordance with a specific investment policy.

The alternative investment fund market is growing rapidly with each passing year. According to Ernst & Young (EY), the total value of the AIF market will exceed $23 trillion by 2026. This is an incredible growth compared to 2019, when the value was just $10 trillion.

Some of the largest alternative investment funds in the world are:

• Blackstone – Assets under management: $1.1 trillion

• Brookfield – Assets under management: $1 trillion

• Hamilton Lane – Assets under management: $947 billion

• Apollo Global Management – Assets under management: $733 billion

• KKR – Assets under management: $633 billion

Most of these funds are located in America, but the AIF market is growing worldwide.

Conclusion

Alternative investments are becoming increasingly popular and for many people seem more accessible than traditional investments. This field continues to develop and has yet to reach its peak.

Alternative investments are more complex than traditional ones, often illiquid, and less transparent – these are disadvantages, especially for new investors who are just entering the world of finance.

Therefore, it is important to inform yourself well and choose an investment that best suits your financial goals and budget.