Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

7 Reasons to Invest in Gold

Investing is a crucial part of securing financial stability and growth. Among the plethora of investment options available, gold stands out as a time-honoured choice. Its allure goes beyond mere aesthetics; gold has been a symbol of wealth and a robust investment for centuries.

But why should you consider adding gold as a precious metal to your portfolio today? Let’s delve into the seven compelling reasons to invest in gold.

Why Invest in Gold?

Historical Significance

Gold has been revered since ancient times. It was used as currency, in jewelry, and as a status symbol by civilisations like the Egyptians, Romans, and Greeks.

The gold standard, which pegged the value of currencies to a specific amount of gold, further cemented its importance in the economic landscape. Even though the gold standard is no longer in use, gold’s historical value continues to influence its market perception.

Gold as a Tangible Asset

Unlike stocks or bonds, gold is a physical asset. You can hold it in your hand, store it in a safe, or pass it down through generations. This tangibility means it doesn’t depend on a company’s performance or government stability. Gold’s intrinsic value is recognised globally, making it a reliable investment.

Universal Acceptance of Gold

Gold is universally accepted as a valuable commodity. Regardless of the economic climate or geographical location, gold retains its worth. It acts as a global currency, often sought after during economic crises. This universal acceptance makes gold a stable and trustworthy investment.

7 Compelling Reasons to Invest in Gold

1) Hedge Against Inflation

One of the primary reasons investors turn to gold is its ability to hedge against inflation. Over the years, gold has maintained its purchasing power, even as the value of fiat currencies fluctuates. Historical data shows that during periods of high inflation, the price of gold tends to rise, protecting your wealth from eroding.

2) Portfolio Diversification

Diversifying your investment portfolio is essential for risk management.

Gold has a low correlation with other asset classes like stocks and bonds

This means that when the stock market is volatile, gold often remains stable or even appreciates, providing balance to your portfolio.

3) Safe Haven During Economic Downturns

Gold’s reputation as a safe haven is well-deserved. During economic downturns or financial crises, investors flock to gold. This behavior is based on historical trends where gold prices have surged during times of uncertainty. For instance, during the 2008 financial crisis, gold prices skyrocketed as other assets plummeted.

4) Protection Against Currency Fluctuations

Gold acts as a shield against currency fluctuations. When the value of a currency declines, gold often increases in value. This makes it an attractive option for investors looking to protect their assets from currency depreciation, especially in countries with volatile currencies.

5) Liquidity and Accessibility

Gold is highly liquid, meaning it can be easily bought or sold without a significant price discount. Whether you own physical gold or gold securities, the market for gold is vast and active, ensuring that you can quickly convert your investment into cash when needed.

6) Long-Term Store of Value

Gold has been a store of value for thousands of years. Unlike paper currency or other assets that can lose value or become obsolete, gold has preserved wealth over long periods. It is often seen as a generational asset, passed down to maintain family wealth.

7) Growing Industrial Demand

Beyond its role as an investment, gold has substantial industrial demand. It is used in electronics, medical devices, and the jewellery market. As technology advances and the global economy grows, the demand for gold in these industries is likely to increase, potentially driving up its value. With rising demand the supply and demand dynamics of the gold market will shift, potentially making it more valuable.

How to Start Investing in Gold

There are several ways to invest in gold, each with its advantages and considerations:

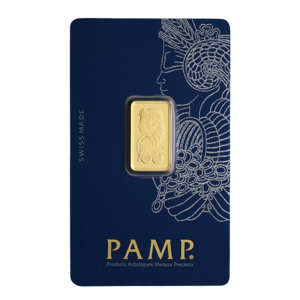

- Physical Gold: This includes gold bars, coins, and jewellery. Physical gold offers the tangibility and security of owning the asset directly but requires safe storage and insurance. Shop our selection of physical gold here on the Tavex website.

- Gold ETFs: Exchange-traded funds (ETFs) offer a way to invest in gold without the need to store it physically. These funds track the price of gold and can be traded on stock exchanges.

- Gold Mining Stocks: Investing in companies that mine gold can provide exposure to the gold market. However, these stocks are subject to the performance of the company and the mining sector.

- Gold Futures and Options: These are more complex investment instruments that allow you to speculate on the future price of gold. They require a higher level of expertise and carry more risk.

Potential Risks and Considerations

While gold is a valuable investment, it’s not without risks:

- Market Volatility: Gold prices can be volatile, influenced by geopolitical events, economic data, and market speculation in the financial market. Central banks demand for gold and their purchasing patterns may also influence the market price of gold bullion. Read more on the topic here: 5 reasons why central banks buy gold.

- Storage and Insurance Costs: Physical gold requires secure storage and insurance, which can add to the cost of the investment.

- Regulatory Concerns: Depending on your country, there may be regulations on buying, selling, or holding gold. It’s important to understand these rules before investing for both short term and long term considerations.

Key Takeaways

Investing in gold offers a multitude of benefits that can help secure your financial future. Its historical significance and universal acceptance make it a reliable choice in any economic climate. As a tangible asset, buying physical gold provides a sense of security that paper assets cannot.

The seven compelling reasons to invest in gold – hedging against inflation, portfolio diversification, acting as a safe haven during economic downturns, protection against currency fluctuations, high liquidity, long-term store of value, and growing industrial demand – underscore its value as a strategic addition to your investment portfolio.

Gold’s unique qualities make it an indispensable asset for those looking to diversify and safeguard their wealth

Whether you’re just starting out or looking to enhance your existing portfolio, gold offers a robust investment opportunity that has stood the test of time. By understanding the different ways to invest in gold and being aware of the potential risks, you can make informed decisions that align with your financial goals.

In conclusion, the bottom line is that gold is not just a relic of the past; it is a forward-looking investment that continues to hold significant value. Consider adding gold to your investment strategy to take advantage of its enduring benefits and protect your financial future.