Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

What Is Scrap Gold and How Is It Valued?

Scrap gold refers to any gold item that is no longer wanted or usable in its current form but still retains value due to its gold content. It may include broken jewellery, outdated or unfashionable pieces, damaged coins, dental gold, or industrial by-products.

While it may lack aesthetic or collectable value, scrap gold holds significant worth based on its precious metal content. Understanding how scrap gold is classified and valued is essential for anyone looking to sell gold responsibly and profitably.

What Qualifies as Scrap Gold?

Scrap gold encompasses a broad category of gold items that are sold for the value of their gold content rather than their craftsmanship or historical significance. This can include:

- Broken or mismatched jewellery (e.g., single earrings, tangled chains)

- Gold coins or medallions not of numismatic interest

- Dental gold such as crowns or bridgework

- Watch cases, clasps, or gold-plated objects

What all these items have in common is that their primary value lies in the purity and weight of the gold they contain, rather than their design, rarity, or brand.

How Carats Affect the Price

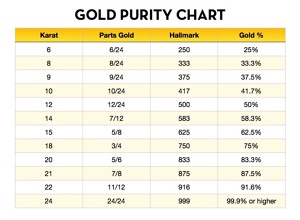

Gold purity is measured in carats (ct), with 24 carat representing pure gold. However, most gold items are made from an alloy of gold and other metals for durability. The carat number tells you how much gold is in the item:

- 24ct = 99.9 % pure gold

- 22ct = 91.6% gold

- 18ct = 75% gold

- 14ct = 58.5% gold

- 9ct = 37.5% gold

The higher the carat, the higher the percentage of gold, and therefore, the more valuable the item per gram. When valuing scrap gold, this purity must be taken into account to calculate the true amount of gold present in an item.

How Scrap Value Is Calculated

The scrap or melt value of a gold item refers to the amount it would be worth if it were melted down and refined into pure fine gold. This is the basis for most scrap gold valuations. The calculation typically involves the following steps:

- Weigh the item – usually in grams.

- Determine the purity – based on the carat, convert to a decimal (e.g., 18ct = 0.75).

- Find the current gold price – in grams or per troy ounce, depending on the market.

- Calculate the gold content – by multiplying the weight by the purity.

- Multiply by market price – to get the theoretical melt value.

For example, a 10g 18ct gold bracelet:

- Contains 7.5g of pure gold (10g × 0.75)

- If gold is priced at £50/g, the melt value = 7.5g × £50 = £375

Take a look at our calculator here, to get a price estimate for your goods.

Factors That Influence Payout

While the melt value gives a theoretical maximum, the actual payout offered by a gold buyer is typically lower. This discrepancy accounts for several factors:

- Refining costs – Melting and purifying gold requires specialised equipment and processes.

- Dealer margins – Gold dealers must factor in their overheads and profit.

- Market fluctuations – Gold prices change daily, and some buyers may offer rates based on a previous day’s price.

- Item condition – Heavily soiled or mixed-metal items may reduce extractable gold yield.

- Trust and transparency – Reputable dealers tend to offer more consistent and competitive rates, especially if they provide transparent pricing and free valuations.

It’s also worth noting that payout rates can vary significantly between buyers. High street pawnbrokers and postal gold services may offer less than specialist bullion dealers or online platforms known for buying investment-grade metals.

Conclusion

Scrap gold remains a valuable commodity, regardless of the condition or appearance of the item. Understanding how gold purity affects value, how melt price is calculated, and what influences the final payout can empower sellers to make informed decisions. For those with unwanted or broken gold items, selling as scrap can be a straightforward way to unlock their intrinsic worth, provided the transaction is made with a trustworthy buyer offering fair and transparent terms.