Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

What if inflation is not temporary?

The growth of the consumer price index has become faster and faster. If it does not slow down in the next 12 months, central banks will have a difficult choice. They have a choice between decisively controlling inflation or supporting the economy and risking even faster price growth in the future, which will eat away at the economy.

October was a good month for stock markets, up 5.8% on the MSCI World Index. The S&P 500 index, which brings together the shares of the largest companies in the USA, rose by as much as 7.2%, reaching a new record level by the end of the month. The value of the Stoxx 50 index, which tracks the shares of large European companies, rose 5.0%. The value of emerging market companies also increased, but at a slightly slower pace: 1.2%.

Bond markets, on the other hand, have been on a downward trend since the summer of 2020, as major governments have made major changes to their fiscal policies to combat the virus. The United States is increasingly embracing the principles of modern monetary policy, which means that fiscal balances have become secondary and politicians are spending and investing as much as they like.

Although economic growth has accelerated significantly since the pandemic crisis and employers are finding it increasingly difficult to find employment, central banks continue to buy bonds, which is essentially equivalent to financing government spending. At the same time, there is a danger that if politicians get used to distributing money loosely, it will be difficult to re-establish financial discipline.

Unbridled price increase

The growth of the consumer price index has become faster and faster. In the United States, for example, annual inflation reached 6.2% in October, the biggest jump in 30 years. At the same time, the (nominal) interest rate on 10-year government bonds was only 1.58%, suggesting a real US dollar interest rate of -4.62%.

Euro-area inflation reached 4.1% year on year in October, exceeding the European Central Bank’s price growth target by more than 2 percentage points. Nevertheless, the European Central Bank will continue its bond-buying program unchanged. Both US and European central bankers seem to believe that the rise in prices is temporary and only a reflection of the fall in prices during the coronary crisis. This seems to be in line with the view that the economic environment is not strong enough to withstand interest rates above 0%.

Milton Friedman argued in 1956 that inflation is always and everywhere a financial phenomenon in which the money supply grows faster than GDP (“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output ”).

However, experience in recent decades shows that money growth alone will not accelerate price rises if consumers do not believe in it. However, this may mean that if the rise in consumer prices finally gains momentum, even central banks will not be able to control it easily and easily with their monetary policy levers.

In addition, the days when central bankers were superstars are a thing of the past. If Alan Greenspan or Mario Draghi were able to influence investors’ future expectations in a few words, now the words of some technology star may have more weight than the statements or persuasions of Jerome Powell or Christine Lagarde.

Although we would like to believe that economics is based a little on reality (actual profits and cash flows) and not just on dreams and expectations, it is dangerous to underestimate the impact of virally spread narratives. If consumer price inflation does not slow down over the next 12 months, central banks will be faced with a difficult choice. They have the choice of taking decisive action to control inflation or supporting the economy and risking even faster price rises in the future, which will eat away at the economy.

Investing in an inflationary environment

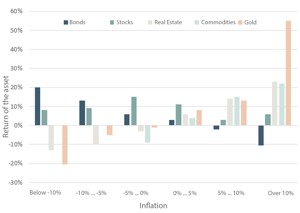

It is widely believed that equities offer good protection against inflation. However, history has shown that stock returns are higher when inflation is slow, and when price and wage growth accelerates, stock returns fall.

Real estate, commodities and precious metals have historically provided better protection against inflation than equities.

In the case of real estate, however, it must be borne in mind that the majority of investors finance their investments in this asset class with bank loans and bonds. In this case, there is a big difference between whether the debt is taken out with a variable or a fixed interest rate. Should the growth rate of consumer prices remain at the current level – twice the target set by the European Central Bank – it is naive to assume that interest rates will remain at current levels as well.

Historically, interest rates have generally been higher than inflation. The current situation, where real interest rates (nominal interest rate minus inflation) are negative, is rather an anomaly. As long as real interest rates are -3%, real estate prices will continue to rise rapidly. However, should real interest rates turn positive, rapid growth could turn into a rapid decline.

As far as British commercial real estate is concerned, it has struck me that although rental prices for commercial real estate are mostly indexed under contracts, they have actually grown much slower than consumer prices – if at all. The rise in British commercial real estate prices has come mainly due to lower interest rates and increasing loan leverage. In addition, in an environment of falling interest rates, investors have been willing to pay ever higher prices for the same flow of rental payments.

We live in an increasingly financialized world, which means that almost every investment and transaction is made with a loan or leverage. While loan-free real estate is a relatively low-risk investment, real estate acquired with little self-financing is anything but risk-free. In this case, more may be lost than was included in the equity transaction.

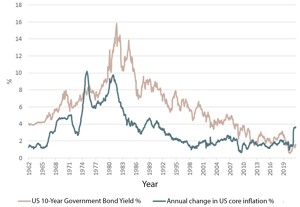

The graph above compares the annual yield on 10-year US government bonds with the country’s annual inflation rate. US real interest rates have only been negative for a very short time in the past.

The economic environment is simply too fragile for that, we are not yet convinced that the future is necessarily inflationary. However, this chart made us think that it is not impossible for inflation expectations to start living. In this case, curbing them will require a truly radical monetary policy and will have a strong impact on all asset classes.

The text was originally written by Andres Viisemann and can be found here.