Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

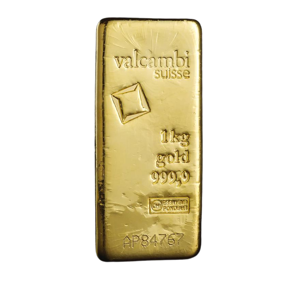

The Infamous 1kg Gold Bullion Bar

The allure of gold has captivated investors for centuries, and in the realm of precious metals, the 1kg gold bullion bar stands as a symbol of wealth and security in investment portfolios. These bars, weighing exactly one kilogram, are a cornerstone in the portfolios of some investors. With their impressive size and inherent value, they serve as a tangible asset in an increasingly digital financial world.

Origin and History

Gold has been a valued medium of exchange and a store of wealth since ancient times. The 1kg gold bar, integral to modern gold investment, emerged from the evolution of gold trading. Historically, gold was traded in various forms, leading to the need for standardisation in purity and weight. This need paved the way for the creation of standardised gold bars.

Today, the 1kg gold bar represents this evolution, being produced with meticulous care for weight and purity by numerous refineries and government mints worldwide. It symbolises the transition from ancient gold trading to a modern, standardised investment asset, maintaining gold’s historical significance in a contemporary financial context.

Significance in the Market

In today’s investment landscape, the 1kg gold bar is a formidable player. Boasting a purity of between 0.995% and 0.9999%, these bars are renowned for their quality and reliability.

Their popularity is particularly pronounced in regions like China and Asia, where they are favoured by high net worth and institutional investors.

These bars are globally recognised for their efficiency in storage and value, appealing to investors managing substantial assets. The international acceptance of 1kg gold bars, supported by reputable refineries and mints, also ensures their liquidity in global markets.

Current Market Price

The price of a 1kg gold bar is influenced by several factors: the gold spot price, the weight of pure gold in the bar, production and refining costs, and market supply and demand. For the most current pricing, investors should consult real-time financial data. This can be found on the Tavex live price charts here.

Investment Potential

The 1kg gold bullion bar is considered an excellent investment for several reasons. Primarily, its significant size offers a cost-effective solution for investors.

Unlike smaller gold bars or coins, the 1kg gold bar generally comes with lower premiums over the gold spot price.

This aspect makes it an attractive option for investors looking to get more gold for their money, particularly for those considering substantial investment.

Additionally, the size and value of these bars make them less suited for frequent trading but ideal for long-term wealth preservation. Investors often choose to store these bars in secure facilities, like bank vaults or private security vaults. This not only ensures the safety of their investment but also indicates their commitment to a long-term investment strategy. This approach is especially favoured during times of economic uncertainty or inflation, where gold has historically served as a stable store of value.

Furthermore, the 1kg gold bar’s liquidity in the global market adds to its appeal. Despite being a large unit, these bars are widely recognised and accepted in gold markets around the world. This ensures that investors can liquidate their assets if needed. This global recognition is backed by the credibility of renowned refineries and mints that produce these bars. This further reassures investors of their authenticity and quality.

The investment potential of 1kg gold bars is also enhanced by their role in diversifying investment portfolios.

Given their stability and resistance to inflation, these bars can act as a hedge against market volatility and currency devaluation.

Alternatives with Better Investment Potential

While 1kg gold bars hold significant appeal for many investors, there are alternative investment options in gold that might align better with different investment strategies and goals. These alternatives include gold coins, smaller gold bars, and gold exchange-traded funds (ETFs), each offering unique benefits.

Gold coins, for instance, are highly liquid and can be more easily traded than larger gold bars. They are often sought after not just for their gold content but also for their historical and collectible value. Coins like the American Gold Eagle or the Canadian Maple Leaf are recognised worldwide, making them a convenient option for investors seeking portability and ease of liquidation.

Smaller gold bars, such as those weighing 10 ounces or less, offer a level of divisibility not found in 1kg bars. This divisibility allows investors to sell portions of their holdings without needing to liquidate a larger bar. It provides flexibility in managing investment portfolios, particularly for those who may wish to capitalise on market fluctuations more frequently.

Gold ETFs present a different approach to gold investment. They allow investors to gain exposure to the price of gold without the need to physically hold the metal. This can be advantageous for investors looking for ease of trading, as gold ETFs can be bought and sold like stocks on major exchanges. Additionally, they eliminate concerns about storage and security associated with physical gold.

Conclusion

For investors wishing to diversify their portfolios with precious metals, the 1kg gold bullion bar is a good financial tool. Its historical relevance, market presence, and investment possibilities make buying this gold bar a desirable asset for both novice and seasoned investors.

Before making an investment decision, individuals should consider the types of investments available, weigh their possibilities, and consider their short term and long-term financial goals.

If you want to buy and sell gold as an asset, smaller gold bars or more liquid alternatives may be a more appealing investment than 1kg gold bars. To ensure a well-thought-out investment, consider your short and long-term goals among a wide range of gold investments.