Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Surging interest on US government debt could cause a crisis

Is the United States facing a potential debt crisis with historically high levels of government debt and a sudden surge in interest payments?

With the Federal Reserve raising interest rates significantly due to high inflation, the country now faces the burden of paying increasingly higher interest on new debt.

When interest rates rise, individuals, businesses, and governments alike face challenges with debt repayment. Let’s take a closer look at the current state of US debt levels and interest payments.

The interest payments in the United States are moving towards a trillion dollars

The US government debt has risen to $31.4 trillion, reaching about 121% of the gross domestic product. While the debt has fallen from its 2020 peak of 135% of GDP, it remains historically high. The rise in interest rates is making it increasingly difficult to service the debt.

In January, the US government reached its debt ceiling, and an agreement has not yet been reached to raise it. Treasury Secretary Janet Yellen has warned that failure to raise the debt ceiling may lead to a global financial crisis. However, this outcome is unlikely, as a deal to raise the ceiling has always been reached in the end.

Annually (based on the year), the US government’s interest payments rose to $853 billion in the last quarter of last year. At the current pace, the government’s annual interest payment on the national debt will soon reach a trillion dollars.

As seen in the graph below, interest payments usually decrease during economic downturns (in gray). This is because the Federal Reserve lowers interest rates and keeps them low during times of economic recession.

Source: FRED. US government debt interest payments (in billions of dollars, quarterly and annually)

Sudden surge in interest payments

After the 2020 COVID-19 crisis, interest payments have surged because interest rates were quickly raised in the spring of last year, and yields on government bonds are increasing. This means that higher interest must be paid on new debt. Since the average maturity of US government bonds is about 74 months, a continuous increase in interest payments is expected in the next few years.

In the 2021 fiscal year, the US government collected $4.08 trillion in revenue, while expenses amounted to $6.85 trillion. In the 2022 fiscal year, revenue reached $4.9 trillion, and the $853 billion interest payment accounts for 17% of this amount. This means that nearly one-fifth of the government’s revenue is currently used to pay only interest, without even including the principal of the loan. It is clear that new loans must be taken out to repay the previous ones, which resembles a Ponzi scheme.

The question arises, where is the limit? At what point do the interest payments become so large for the government that investors question the creditworthiness of the USA? If this happens, the yields on government bonds will quickly rise as risks are seen as greater than before. Then, credit rating agencies will start to lower the USA’s credit rating, which will further increase yields. A spiral could arise that would lead the country into a serious debt crisis, which would likely also result in a financial and economic crisis.

75 percent of the revenues go towards transfer payments

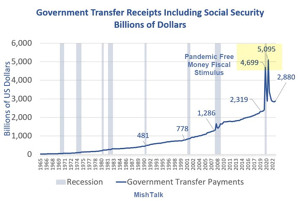

The graph below, compiled by Mish Talk, shows the transfer payments of the US government. These are payments for which the government does not receive goods or services in return. Examples of transfer payments include social security, Medicare, Medicaid, and food assistance.

US government transfer payments (in billions of dollars). Source: MishTalk

Unlike government interest payments, transfer payments tend to sharply increase during economic downturns. When combining interest and transfer payments, we get a total of $3.7 trillion that the government spends without receiving anything in return. This means that transfer payments and interest account for 75% of government revenues.

During the first year of the COVID-19 crisis in 2020, we saw a sharp increase in transfer payments, which resulted in a huge budget deficit for the US government. At the time, it could still be afforded because interest rates were at record lows. Back then, the yield on US 10-year bonds was at 0.6%, but now it has risen to 3.6%. It is reasonable to ask what will happen if a new economic crisis occurs and transfer payments need to be sharply increased again. How is it possible to finance this with the current level of debt and interest payments?

Good solutions don’t exist

In general, there are three solutions to problems that may arise. First, interest rates can be lowered and loans refinanced, which would lower interest payments. This would also mean higher inflation, which helps reduce government debt relative to GDP and alleviate the situation. However, this would mean that the Federal Reserve goes against its goal of avoiding high inflation at all costs and keeping it close to 2%.

The second option is to admit that some debt will not be repaid, which would essentially mean default. This is a rather unlikely scenario, and to prevent this, various methods are used, ranging from minting a trillion-dollar coin to direct government financing through the Federal Reserve.

The third option is to start cutting the government budget and paying off debts. However, this would lead to an economic downturn, as government spending makes up a large part of economic growth. There is practically no political will to implement this.

Now that interest rates are rising in the long run, it will be increasingly difficult to repay interest on debt, as new debt must be issued at higher interest rates. But why are interest rates rising in the long run?

Why should a debt crisis come now?

One of the underlying factors for the emergence of a debt crisis is the fact that the long-term decline in interest rates that began in the early 1980s ended at the bottom of the 2020 spring corona crisis, and now interest rates are rising in the long run. It was a major turning point in many different markets. This marked, for example, the absolute peak of the price ratio of gold and silver and the bottom of oil prices, where WTI crude oil futures fell to as low as -37 dollars.

As inflation has accelerated, central banks have been forced to raise interest rates. This has also led to an increase in the interest rates of government bonds, at a time when the volumes of government debts have risen to very high levels after a long period of cheap borrowing. Although inflation is currently slowing down, rapid inflation is likely to be a long-term process, similar to the 1970s.

This is due to large underlying trends that support price growth, such as the commodity supercycle (long-term price increase), deglobalization, global labor shortages, aging populations, and the fact that central banks are increasingly printing more money in response to crises due to high debt levels. In addition, the velocity of money that has declined for several decades may begin to increase due to rising prices.

Since inflation is likely to be high for a long time, investors want to continue to receive higher interest on their debt. Currently, the real yield on government bonds is negative, which means that at the same level of inflation, the investor incurs a guaranteed loss. Currently, inflation is expected to slow down, and as a result, the yield on government bonds has temporarily declined, but the long-term trend is upward and the markets are not yet fully taking this into account.

In conclusion, the United States is facing a potential debt crisis with historically high levels of government debt and a sudden surge in interest payments. With the Federal Reserve raising interest rates significantly due to high inflation, the country now faces the burden of paying increasingly higher interest on new debt. This has made it increasingly difficult to service the debt, especially as interest payments are moving towards a trillion dollars annually. The question arises, where is the limit? What happens when the interest payments become so large that investors question the creditworthiness of the USA? While there are three solutions to the problem, each has its challenges and limitations. Additionally, the long-term rise in interest rates is making it increasingly difficult to repay interest on debt, and the underlying trends that support price growth suggest that inflation will be high for a long time. Therefore, the possibility of a debt crisis in the United States is a significant concern that needs to be closely monitored.