Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Inflation: Farmland Prices are Rising in Both the US and Europe

Farmland is becoming an increasingly important asset, and its prices have started to grow rapidly in recent years, both in Europe, and the USA, alongside gold.

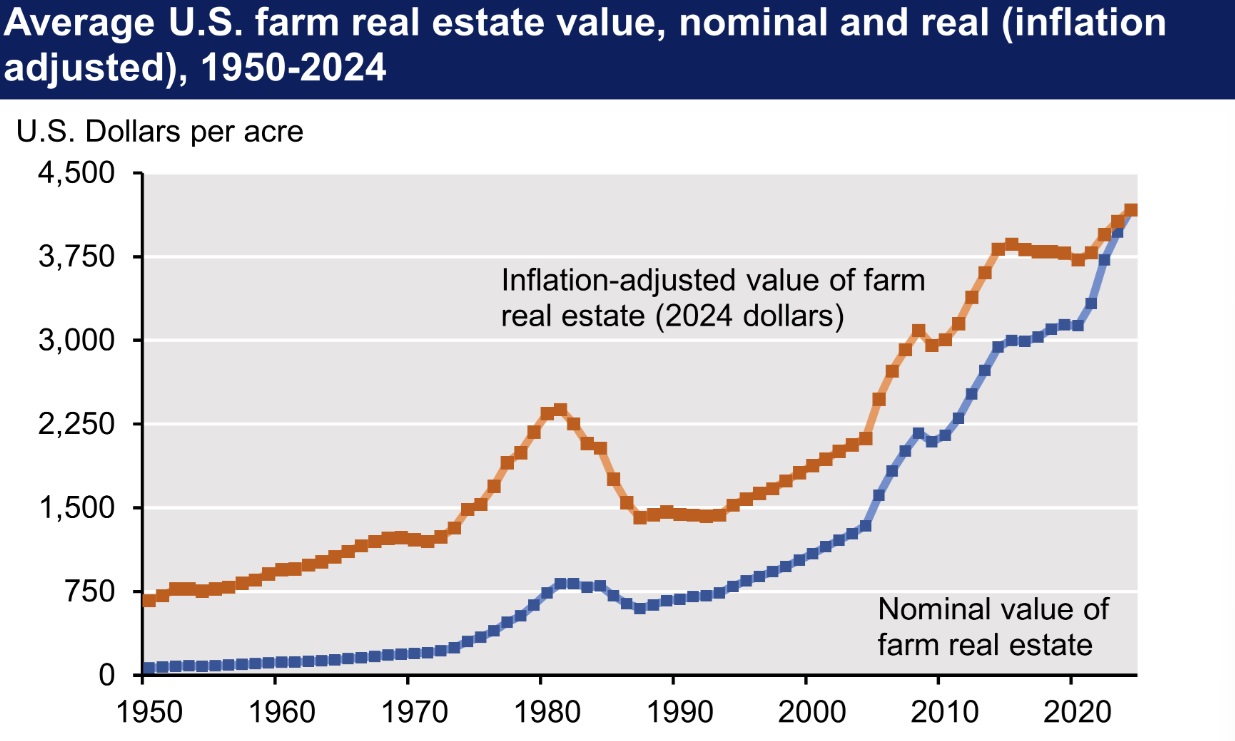

A recent report from the US Department of Agriculture shows that the price of an acre of agricultural land reached $4,350 this year. If this is converted into hectares, the price per hectare becomes $10,750.

In 2011, an acre of agricultural land cost $2,300. If the price increase is adjusted for the official inflation rate, the price of land has also increased over the long term.

Looking at long-term data, land prices have increased nearly threefold, adjusted for inflation, since the early 1990s. So owning land has been a pretty good hedge against inflation in the US. We can see that in the last decade, price growth was almost non-existent, but now land prices have started to rise again. This is mainly due to the wave of inflation that has hit the world.

The graph below shows the prices of US agricultural land since 1950. The orange colour shows the inflation-adjusted price of land (at 2024 prices), and the blue color shows the nominal price. The graph comes from the US Department of Agriculture website.

Unlike currencies and many other paper assets, farmland is a tangible asset class with extremely high production potential. The world’s population is growing and the demand for healthier food is increasing. Since farmland is a finite resource, there is less and less of it for each person on Earth. Due to environmental problems and population growth, fertile farmland is becoming an increasingly important asset.

All of the above means that farmland is a good store of value and helps to mitigate risks related to global instability and inflation

In Europe, arable land prices have also been accelerating in recent years. Below are the changes in the price of agricultural land per hectare in Estonia, Bulgaria, Denmark, Sweden, Finland, France and Poland from 2014 to 2023. If you look at European statistics, you can see that land prices in Eastern European countries have grown much faster than in Western Europe. For example, in France, agricultural land prices have remained practically unchanged over the past decade.

Land is a Real Asset

In the case of land, it is a real asset that retains its value in the long term and does not disappear. Considering the current state of the global economy, finance and geopolitics, real assets will be extremely important for people in the next 5-10 years.

Namely, it is real assets that help us survive turbulent times, be it changes in the world order, changes in the state order or upheavals (or changes) of the financial and monetary system. It is in the vortex of such events that paper currencies tend to lose a large part of their value.

It is becoming increasingly clear that the world is changing faster and faster, and land is one of the alternative assets, along with gold, that can help protect assets against the inevitable depreciation of currencies. We are likely to see a period when real assets will not only help preserve the value of assets, but also increase it. We saw the same thing in the 1970s and 2000s, when the price growth of real assets significantly exceeded inflation.

Key Takeaways

The steady rise in farmland prices across both the US and Europe underscores the growing importance of agricultural land as a reliable store of value. With global population growth, increasing food demand, and the finite supply of fertile land, farmland offers both scarcity-driven appreciation and tangible utility.

Historical trends show that it has consistently outperformed inflation over the long term, particularly during periods of economic uncertainty and monetary instability.

As the world faces accelerating geopolitical, financial, and environmental challenges, farmland stands alongside gold and other real assets as a strategic hedge – capable not only of preserving wealth but potentially enhancing it in the coming decade.