Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

How to Protect Your Bullion Investment from Losing Its Value

Investing in bullion, such as gold, silver, and platinum, is often considered a safe haven for wealth preservation. However, ensuring your investment retains its value requires more than just purchasing it – it demands strategic planning and vigilance. In this guide, we’ll explore how to protect your bullion investment from losing its value and help you safeguard your financial future.

Understanding Bullion Investment

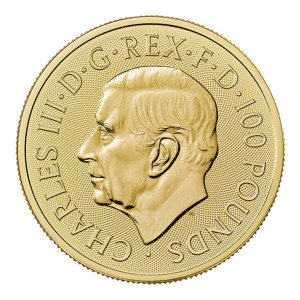

Bullion refers to precious metals in their purest form, typically in the form of bars, coins, or ingots. It is valued for its intrinsic worth and historical significance as a currency.

Popular Types of Bullion

The most commonly traded bullion includes:

- Gold: A universal store of value.

- Silver: A more affordable alternative with industrial applications.

- Platinum: A rarer option often tied to automotive and industrial demand.

Many people invest in bullion as a hedge against inflation, currency devaluation, and economic uncertainty. Additionally, precious metals serve as a means of portfolio diversification, making it a valuable asset class for both seasoned and novice investors.

Factors That Affect Bullion Value

Understanding the factors that influence gold and silver prices is essential for protecting your investment. Market demand and supply, global economic trends, inflation and currency fluctuations all play a role in affecting the value of bullion.

- Market demand and supply play a significant role, as scarcity or heightened demand can cause prices to rise.

- Similarly, global economic trends, such as recessions or geopolitical tensions, often drive investors to bullion as a safe haven, thereby increasing its value.

- Inflation and currency fluctuations also have a direct impact; when fiat currencies weaken, bullion often appreciates in value.

Common Risks to Bullion Investments

While precious metals are considered a stable investment, it is not without risks. Market volatility, fraud, and physical damage and theft all are common risks when investing in bullion.

Market volatility can lead to sudden price fluctuations, affecting the value of your holdings

Fraudulent schemes, including counterfeit bullion and dishonest dealers, can also pose significant threats. Furthermore, physical damage or theft can compromise the value of your investment, especially if your bullion is not stored securely.

How to Safeguard Your Investment

1) Secure Storage Options

One of the most important aspects of protecting your bullion investment is secure storage. A fireproof and tamper-resistant safe at home can provide adequate protection for smaller collections. Bank safety deposit boxes offer offsite security, although they may involve recurring fees. For maximum security, many investors turn to professional vaulting services, trusted by high-net-worth individuals.

2) Proper Handling Practices

Proper handling is essential to maintaining the value of your bullion. Always wear cotton or nitrile gloves when handling bullion to prevent oils, dirt, and moisture from tarnishing or staining its surface.

Avoid excessive handling, as even minimal contact can lead to scratches or damage

If you need to inspect your metals, use padded surfaces and avoid abrasive materials to preserve its pristine condition.

3) Diversification of Investment

Diversifying your portfolio can also mitigate risks. Balance your bullion holdings with other asset classes, such as stocks, bonds, or real estate. Within the bullion category itself, consider diversifying across different metals, such as gold, silver, and platinum, to stabilise your investments.

Avoiding Counterfeits

To avoid counterfeit gold and silver, it’s imperative to purchase from reputable dealers.

Always verify the credibility of the dealer by checking their industry certifications and customer reviews. Additionally, insist on proof of authenticity, such as certification and proper documentation.

If you are uncertain about the legitimacy of your bullion, various at-home testing methods can help

For example, the magnet test can determine if a metal is truly gold or silver, as these metals are non-magnetic. Acid test kits are another option, revealing the metal’s composition with a simple procedure.

Timing Your Investment Decisions

Timing is critical in precious metals investment. Understanding market cycles can help you identify buying and selling opportunities, and keeping an eye out for changes in bullion prices is very important. For example, purchasing gold or silver during a market dip allows you to acquire it at lower prices, while selling during peak periods maximises your returns.

Staying updated on global economic trends is equally important. Monitoring news and expert analyses can provide valuable insights into market conditions, helping you make informed decisions.

Key Takeaways

The bottom line is that protecting your precious metals investment requires a combination of secure storage, proper handling, diversification, and informed decision-making. To retain the value in your gold investment make sure to take good care of your product.

By understanding market dynamics, avoiding counterfeit products, and seeking professional advice when needed, you can ensure your investment portfolio retains its value over time.

FAQs

1) How do I choose the best type of bullion for investment?

Gold is often the safest option for beginners, but your choice should depend on your budget, goals, and market trends. Investing in gold is unique for each individual and will differ from person to person.

2) What is the safest way to store gold and silver?

Professional vaulting services offer the highest level of security, but home safes and bank safety deposit boxes are also reliable options for physical gold coins and bars.

3) Why is wearing gloves important?

Gloves prevent oils, dirt, and moisture from tarnishing or damaging the metal’s surface, preserving its pristine condition. This may allow you to sell your product back for a higher price back to bullion dealers.

4) Are there tax benefits to investing in bullion?

Yes, certain tax-efficient strategies, such as holding bullion in specific accounts, can reduce your tax liabilities. Bullion coins produced by The Royal Mint are exempt from CGT tax.

5) Should I buy bullion during a market dip?

Yes, purchasing during market dips in the financial market allows you to acquire bullion at lower prices, maximising long-term returns.