Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

5 Things to Consider When Purchasing Gold Bars

Investing in gold bars is a time-honoured tradition, a practice that has been around for centuries. Whether you’re a seasoned investor or a beginner, buying gold bars can be a smart move for your investment portfolio. However, like any investment, it requires careful consideration and attention to detail.

In this article, we’ll walk you through the five crucial things to look out for when buying gold bars. By the end, you’ll be better equipped to make informed decisions that safeguard your investment and maximise your returns.

1) Authenticity of Gold Bars

A consideration when purchasing gold bars is ensuring their authenticity. With the market for gold being as lucrative as it is, there are numerous scams and fraudulent activities surrounding it.

Common Frauds and Scams

Fake gold bars and counterfeit schemes are unfortunately common. These can range from gold-plated bars to sophisticated tungsten-filled bars that can deceive even experienced investors.

Falling victim to such scams can result in significant financial losses

Hallmarks and Stamps

One of the simplest ways to verify the authenticity of a gold bar is by checking for hallmarks and stamps. Reputable manufacturers imprint their gold bars with specific marks that indicate the purity, weight, and sometimes the year of production. Look for these marks as a preliminary check.

Certification and Assay

Certification from a recognised assay office provides an additional layer of assurance. These certificates confirm that the gold bar meets the specified purity and weight standards. Ensure that the gold bar comes with such certification from a reputable source.

2) Purity of Gold Bars

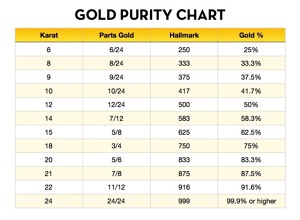

Gold purity levels is a critical factor that determines the value of a gold bar. Purity is often denoted in karats or fineness, with higher numbers indicating purer gold.

Karats and Fineness

Gold is typically measured in karats (K) or parts per thousand (fineness). For instance, 24K gold is considered pure gold, while 18K gold consists of 75% gold and 25% other metals. Similarly, a fineness of 999 means the gold bar is 99.9% pure.

Testing Purity

One of the traditional methods for testing gold purity is the acid test. This involves scratching the gold bar slightly and applying a drop of acid to the scratch. The colour change indicates the purity level.

For a more advanced and accurate method, an XRF (X-ray fluorescence) analyser can be used

This device measures the gold content without damaging the bar, providing precise information about its purity.

3) Weight and Size of Gold Bars

Gold bars come in various weights and sizes, ranging from small gram bars to larger kilogram bars. The choice depends on your investment goals and budget.

Impact on Investment

The weight and size of a gold bar directly impact its price and liquidity. Smaller bars are generally easier to sell and trade, while larger bars might offer better value per ounce but can be harder to liquidate quickly.

Read more on the topic here: The infamous 1kg gold bar

Choosing the Right Weight for You

Consider your investment strategy when choosing the weight and size of gold bars. If you’re looking for flexibility and ease of sale, smaller bars might be the better option. For long-term investment and value, larger bars could be more suitable.

4) Reputation of the Dealer

The reputation of the bullion dealer you purchase from is paramount. A trustworthy dealer ensures that you receive genuine, high-quality gold bars and provides support and services that protect your investment.

Check online reviews and ratings of dealers before making a purchase. Look for consistent positive feedback and any red flags in customer experiences.

Look at Tavex Bullion’s trust pilot reviews here: Reviews

Dealers with industry certifications and memberships in reputable associations (such as the London Bullion Market Association) are more likely to adhere to high standards of business practice.

5) Market Conditions and Timing

Gold prices fluctuate based on various economic indicators and market conditions. Understanding these fluctuations can help you make a more informed purchase.

Read more on the topic here: What is happening to the price of gold?

Best Times to Buy Gold

There isn’t a one-size-fits-all answer to the best time to buy gold. However, generally, purchasing during economic downturns or when market sentiment is low can result in better prices.

Keeping an Eye on Economic Indicators

Economic indicators such as inflation rates, currency strength, and geopolitical events can significantly impact gold prices. Staying informed about these factors can help you time your purchases more effectively.

Key Takeaways

Buying gold bars is a significant investment that requires thorough research and careful consideration.

By focusing on authenticity, purity, weight and size, dealer reputation, and market conditions, you can make more informed decisions and safeguard your investment.

Remember, knowledge is your best ally when it comes to investing in precious metals.

FAQs

1. What is the difference between gold bars and gold coins?

Gold bars are typically used for investment purposes due to their lower premiums over spot price, whereas gold coins can have collectible value and often come with higher premiums.

2. How can I store gold bars safely?

There are many storage options to choose from. Gold bars should be stored in a secure location, such as a safe deposit box at a bank or a home safe.

3. Is it better to buy gold bars or gold ETFs?

It depends on your investment goals. Gold bars offer physical ownership, while gold ETFs provide exposure to gold prices without the need for storage and security concerns.

4. Can I sell gold bars easily?

Yes, gold bars can be sold through dealers, bullion exchanges, or online platforms. Smaller bars tend to be easier to sell than larger ones.

5. What are the tax implications of buying gold bars?

Tax implications vary by country. In some places, purchasing gold bullion bars might be subject to sales tax, and capital gains tax could apply upon selling them. Consult a tax advisor for specific details.