Tavex uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

5 Factors to Consider When Buying Gold

Investing in gold is a significant decision that requires careful thought and planning. Whether you are buying gold as an investment, a collectible, or a piece of jewellery, understanding the key factors that influence your purchase can help ensure that you make a sound decision.

Here are five crucial points to consider when buying gold.

1. Choosing a Reputable Dealer

The first step in buying gold is to select a reputable dealer. This choice can influence not only the price you pay but also the assurance of the gold’s purity and legitimacy.

A credible dealer should have transparent business practices, positive customer reviews, and proper accreditation. You should check your bullion dealer sources their products and has partnerships with esteemed mints, such as The Royal Mint, and other refineries. Trustworthy dealers will provide clear information about the products and a professional level of customer service.

To book a complementary consultation with Tavex please call us on +44 (0)20 4541 4145, or email us at tavex@tavexbullion.co.uk.

2. Purity

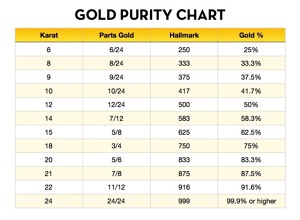

Gold purity is a critical factor in determining its value and suitability for different purposes. Purity is measured in karats, with 24 karats being considered pure gold in bullion markets

Most gold products, especially those used in jewellery, are often mixed with other metals like copper or silver to form a gold alloy to enhance durability. The purity affects not only the price but also the appearance and structural integrity of the gold item. It’s vital to choose the appropriate karat level based on your needs and budget.

3. Weight

Gold, as a precious metal, is typically sold by weight, with common measurements being grams, ounces, or kilos. The weight of a gold item not only impacts its price but also its potential for appreciation as an asset.

When purchasing forms of gold, ensure the weight is verified and accurately reflected in the price. This is particularly important when buying gold for investment purposes, as the weight directly correlates to its value.

The weight of your gold will depend on your investment budget, as the higher the weight the more expensive the gold.

4. Authenticity

Authenticating your gold purchase is crucial to ensure its value and legitimacy

Look for items that come with certificates of authenticity from trusted sources. This also enhances the buying and selling ability of your product.

Additionally, most genuine gold products are stamped with hallmarks that indicate their purity. These marks are usually located in discrete areas such as the clasp of a necklace or the inner band of a ring. Always check for these marks to confirm that the gold is as pure as claimed.

5. Premium Over Spot Price

The spot price of gold is the current market price per ounce.

Have a look at the live price of gold here.

However, when purchasing gold products, you are likely to pay a premium over this price. It is important to consider the market value vs the selling price, which is the premium.

This premium covers the costs of fabrication, distribution, and a small dealer markup

The size of the premium can vary based on the form of product’s (bars, coins, gold jewellery), its rarity, and the current demand for gold. When buying gold, compare the premium over the spot price between different dealers to ensure you’re getting a competitive rate. Additionally, when selling gold you should consider the price you paid for your gold and the new price it is being bought back across a variety of dealers.

Conclusion

Purchasing gold is an endeavour that demands careful attention to detail and an informed approach. Whether for investment, collectibility, or personal adornment, the factors outlined – choosing a reputable dealer, ensuring the purity and weight of the gold, verifying its authenticity, and understanding the premium over spot price – are fundamental.

By evaluating these elements, you can navigate the complexities of the gold market with confidence. Remember, the key to a successful gold purchase lies not only in understanding these essential aspects but also in being vigilant about the fluctuations in the gold market and staying updated with current trends to ensure your asset can act as a hedge against inflation.

This diligence will empower you to make informed decisions that align with your financial goals and personal preferences, ultimately enhancing the worth and enjoyment of your gold investment.